|

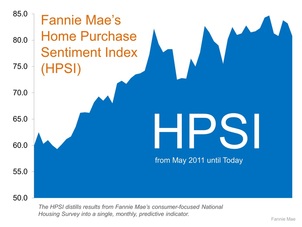

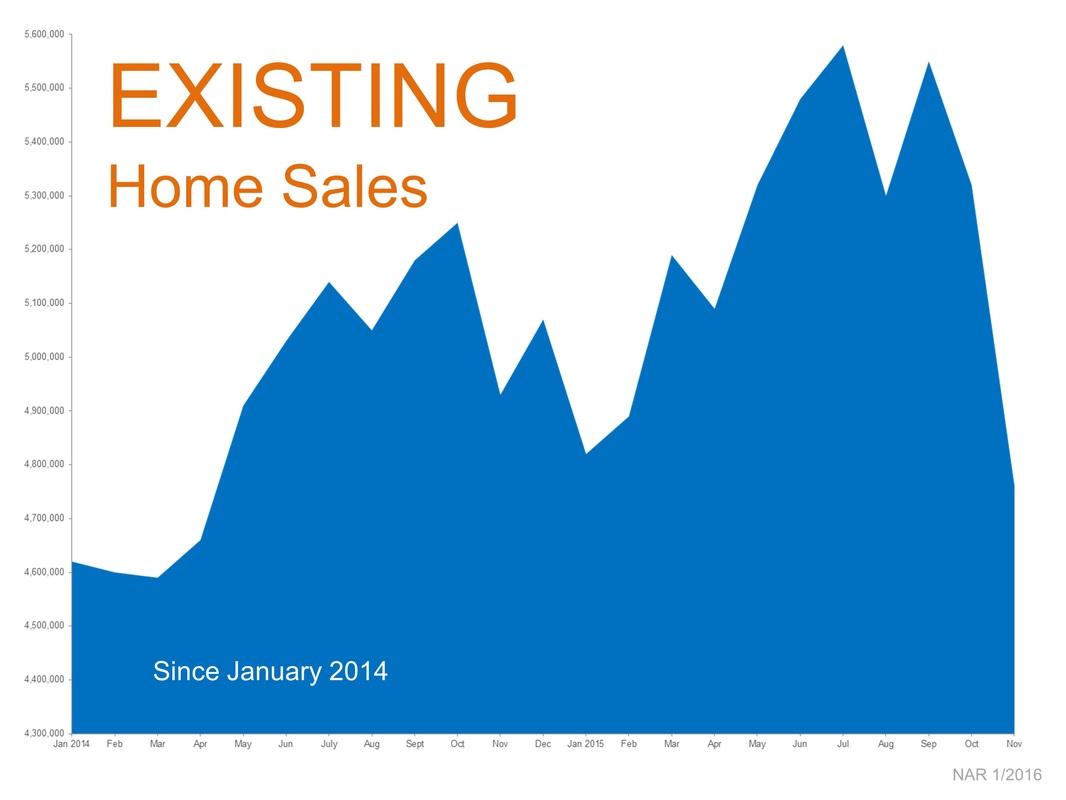

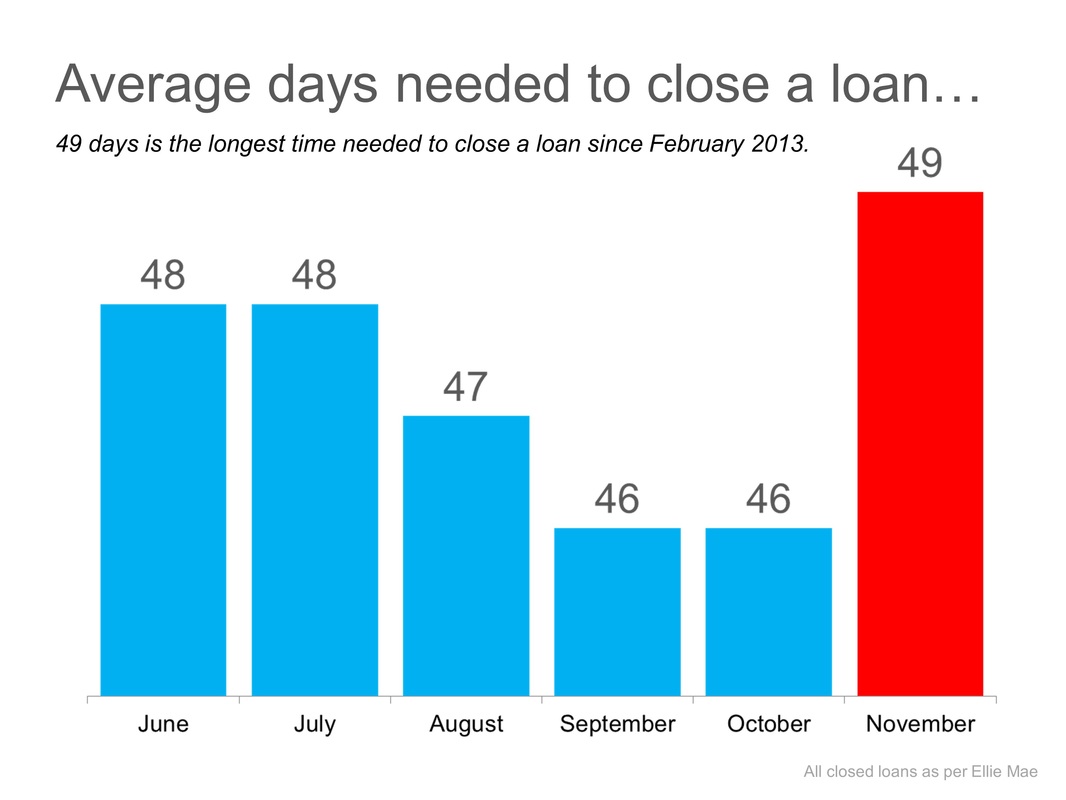

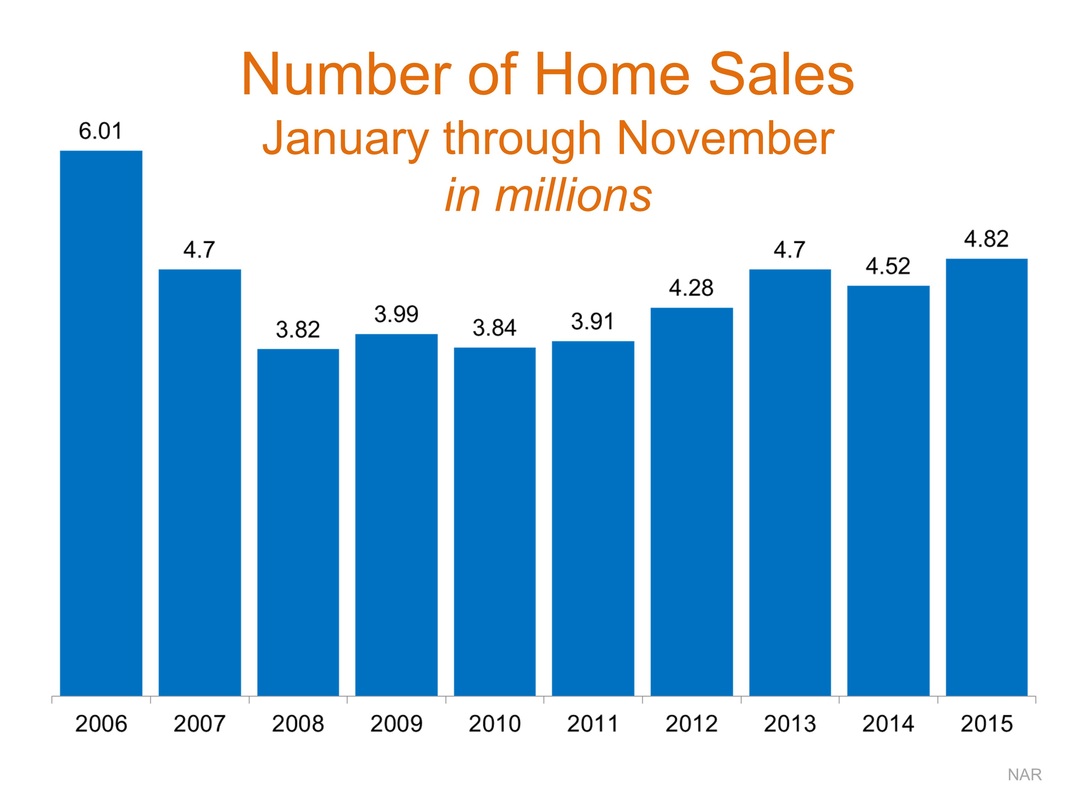

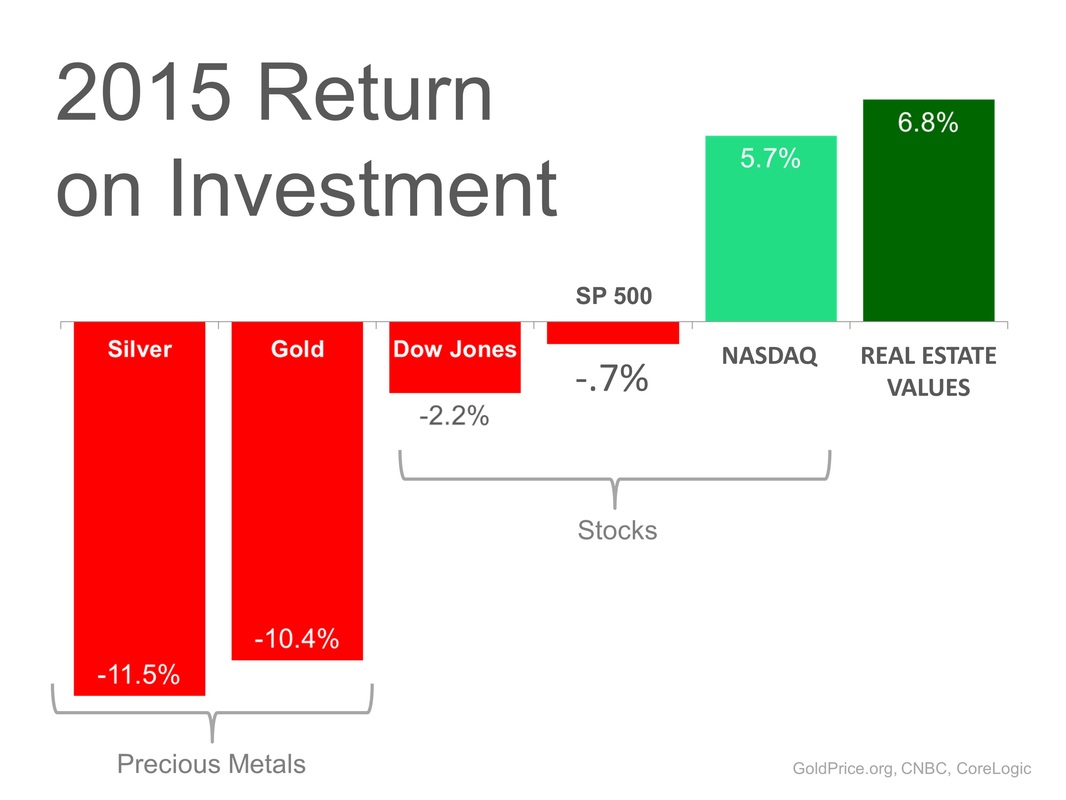

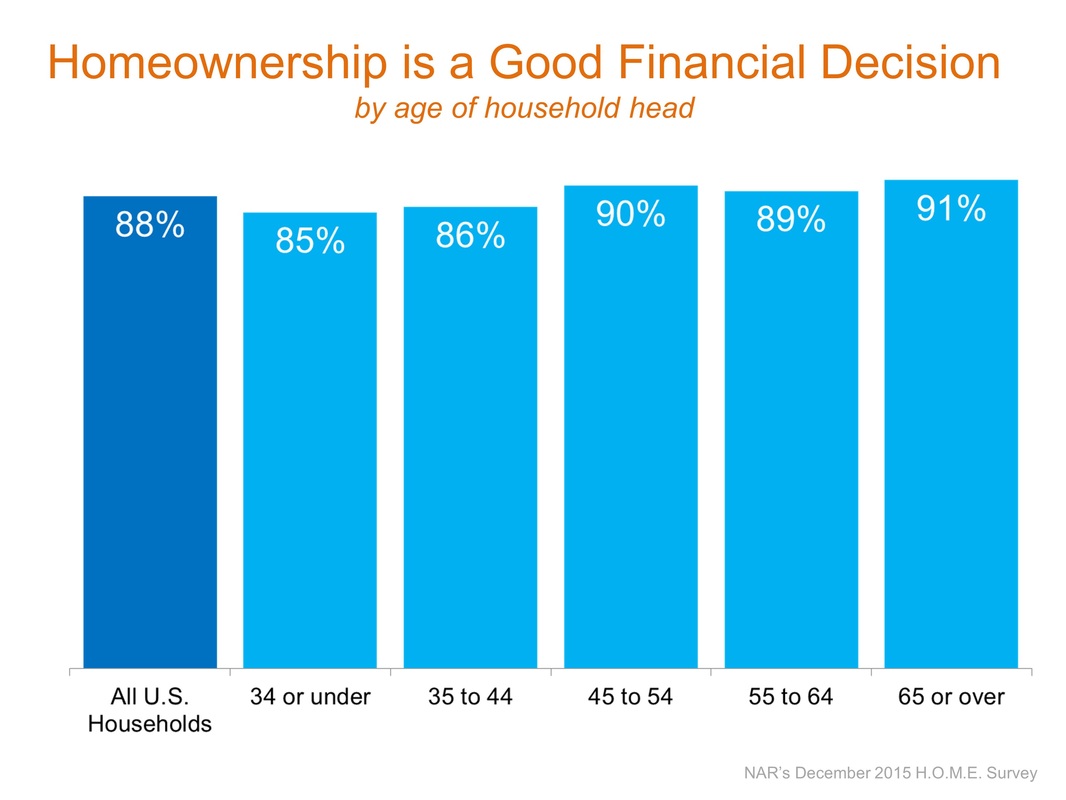

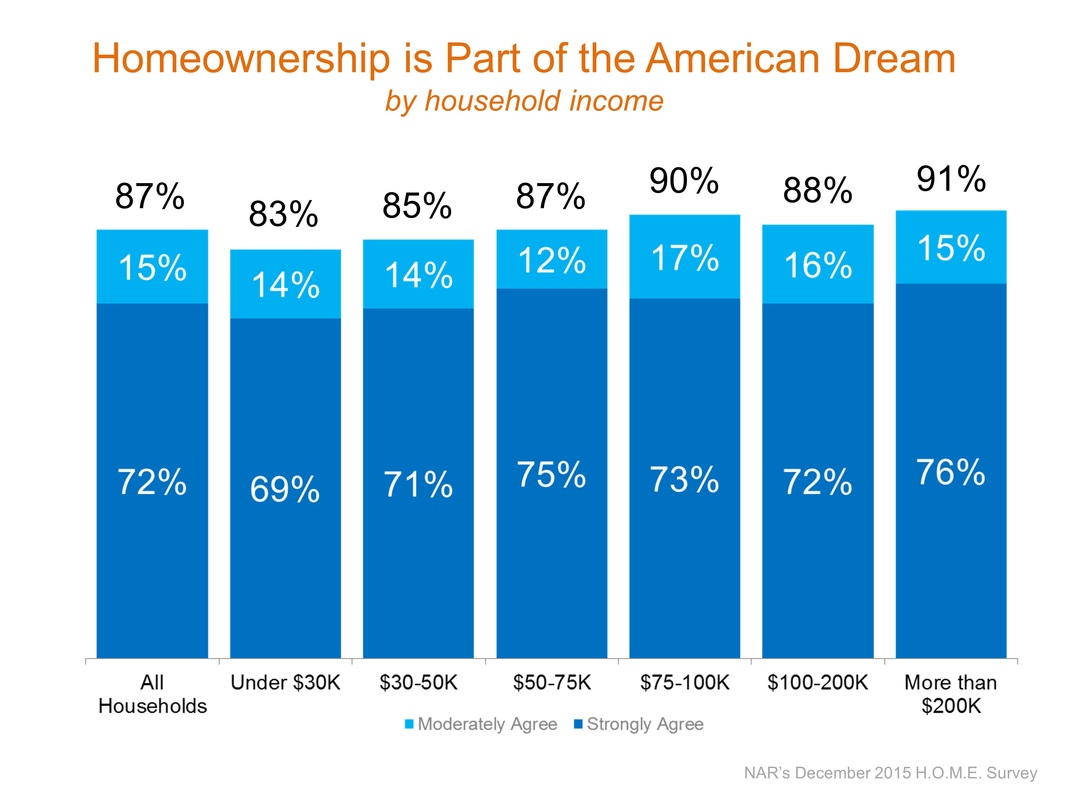

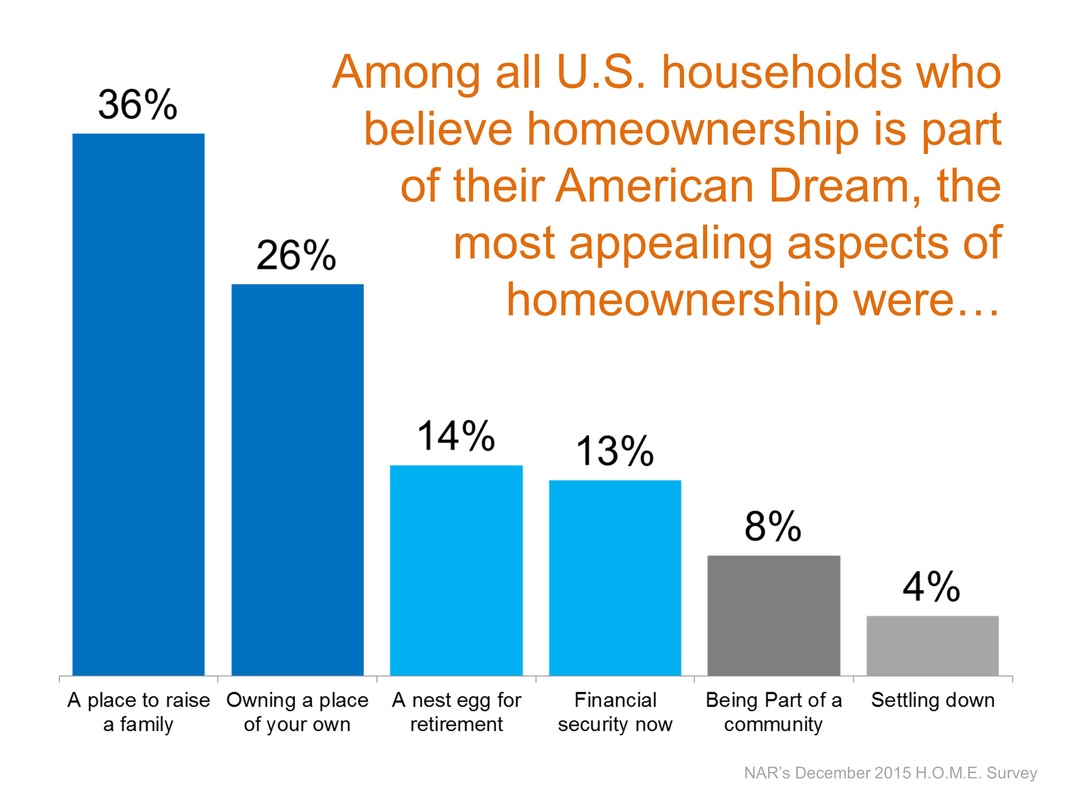

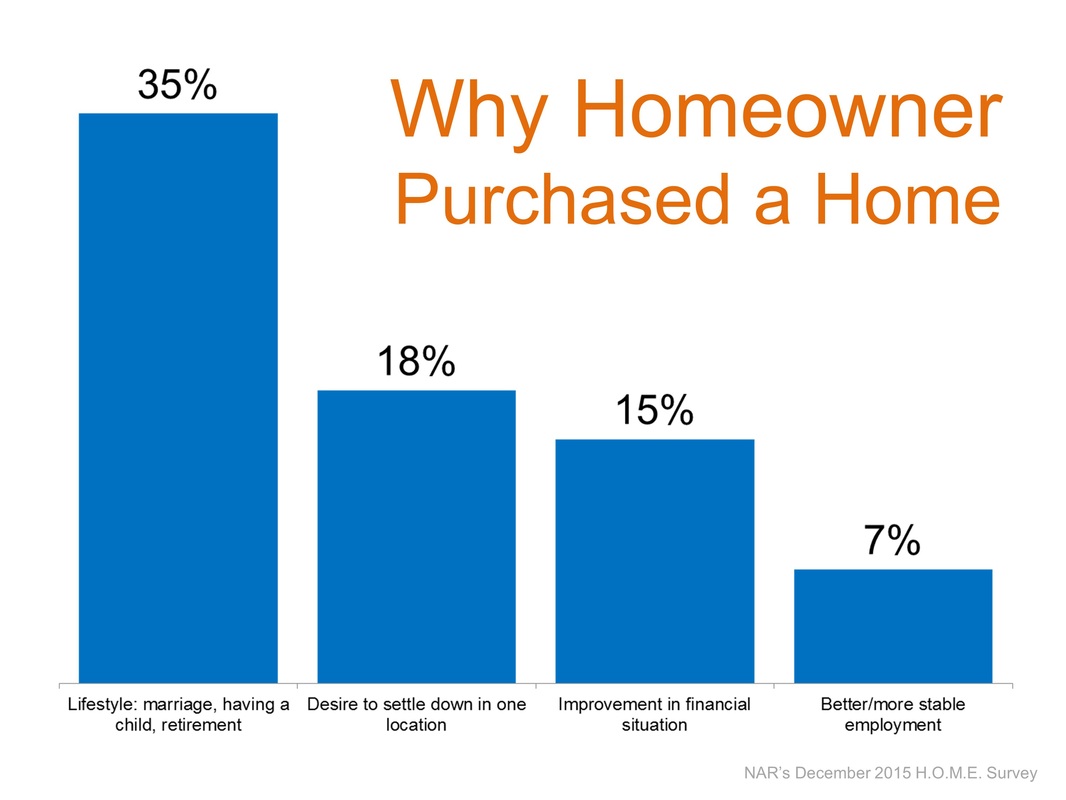

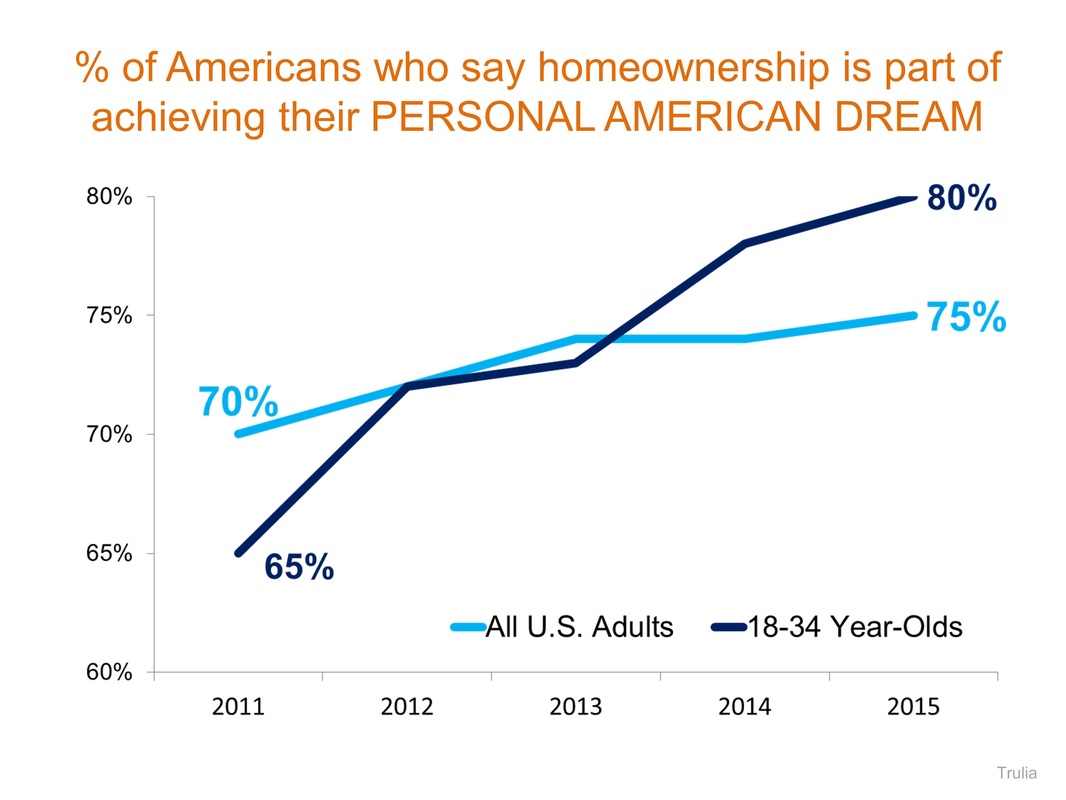

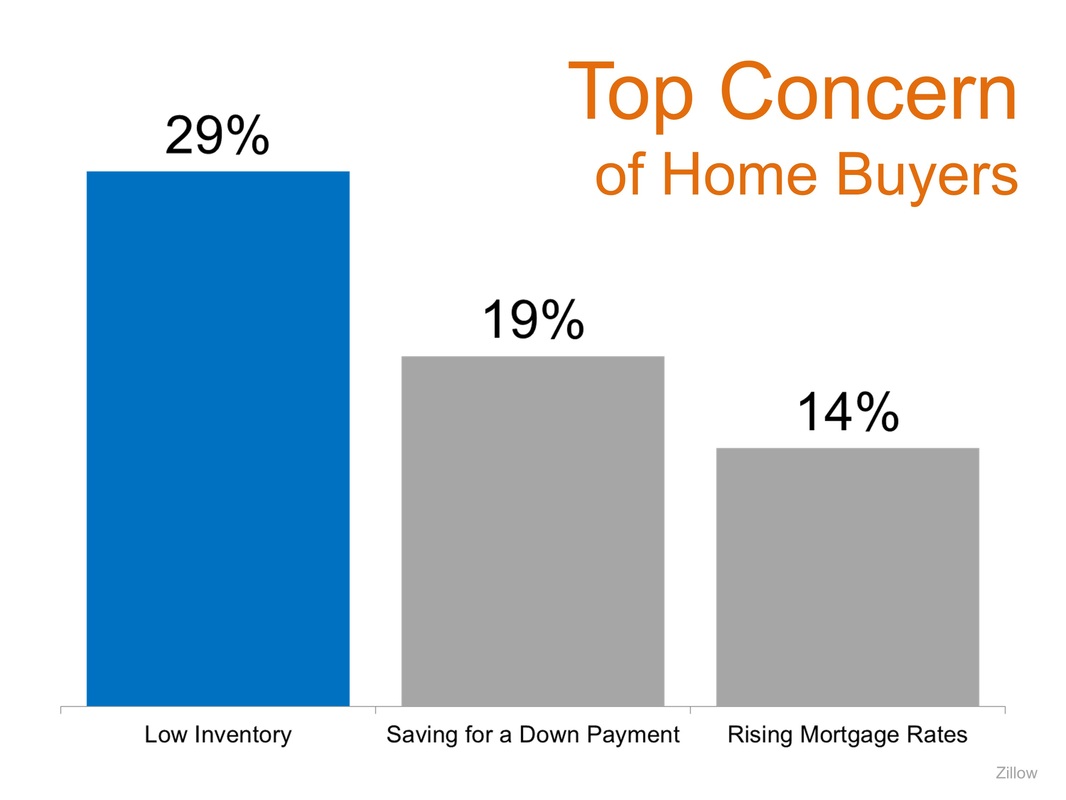

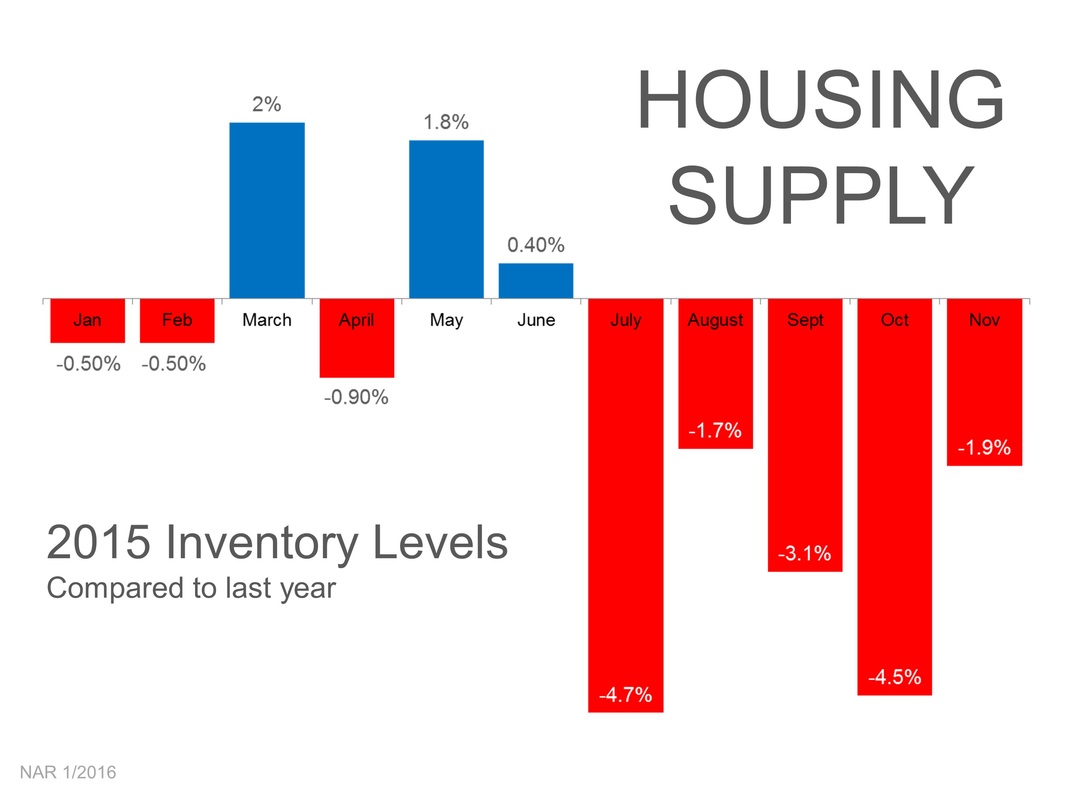

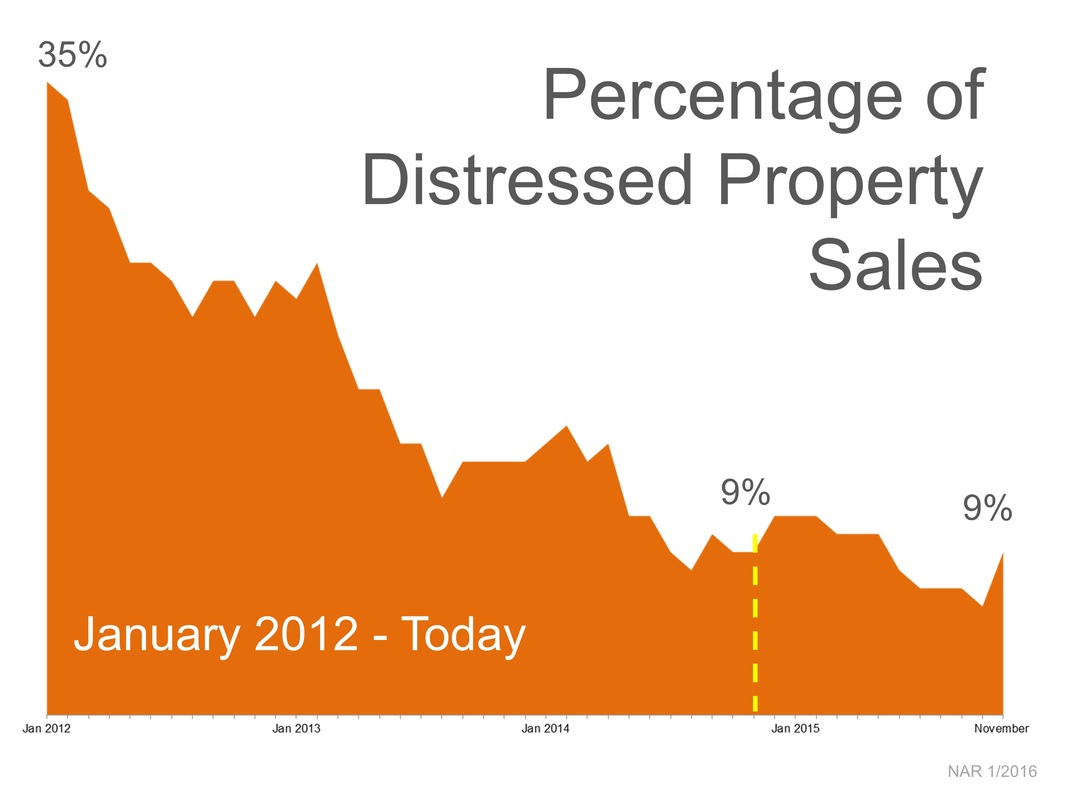

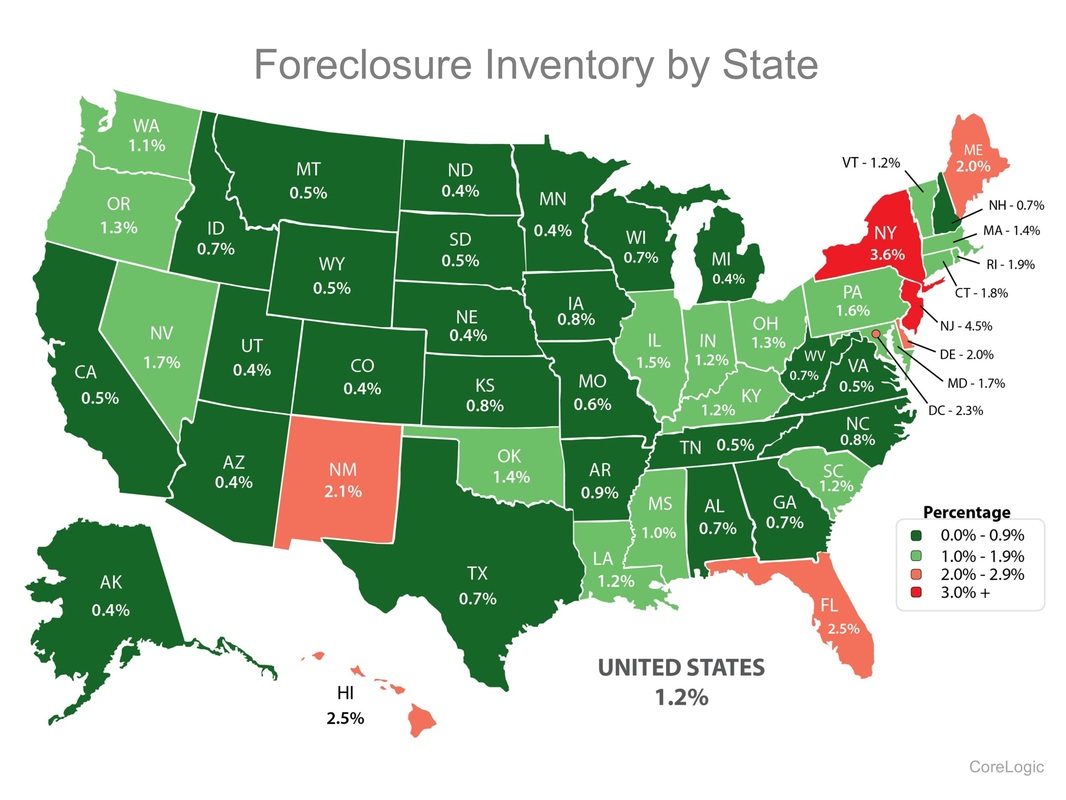

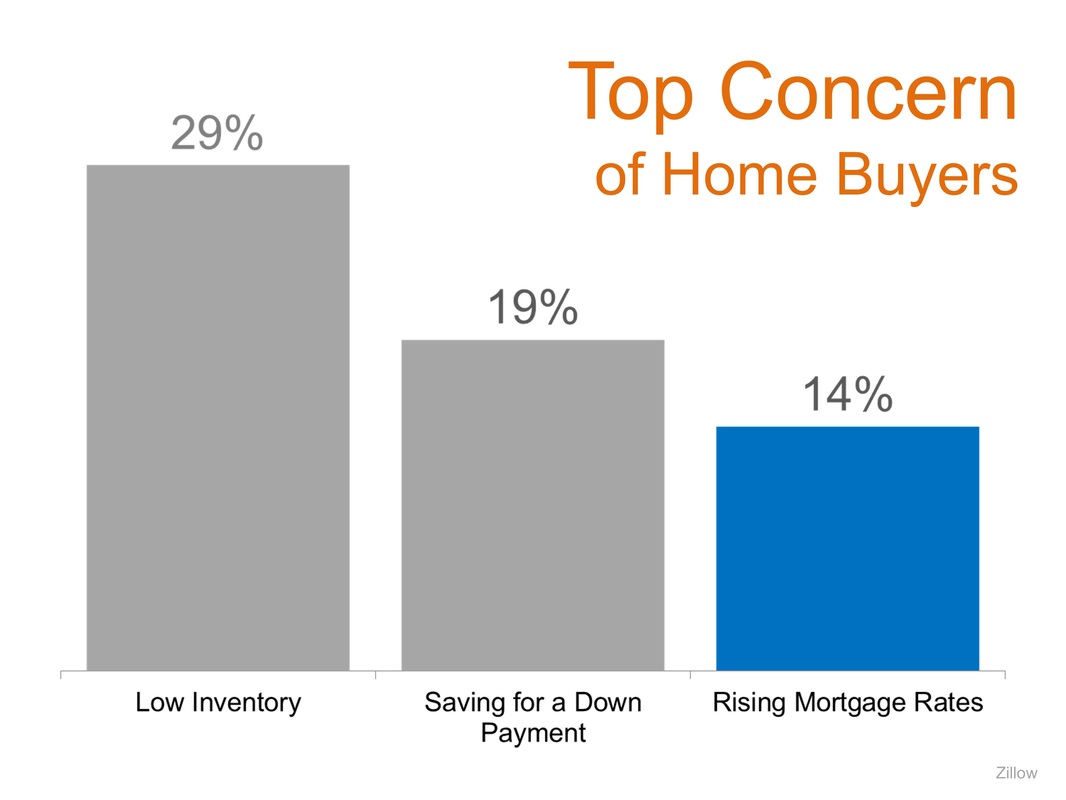

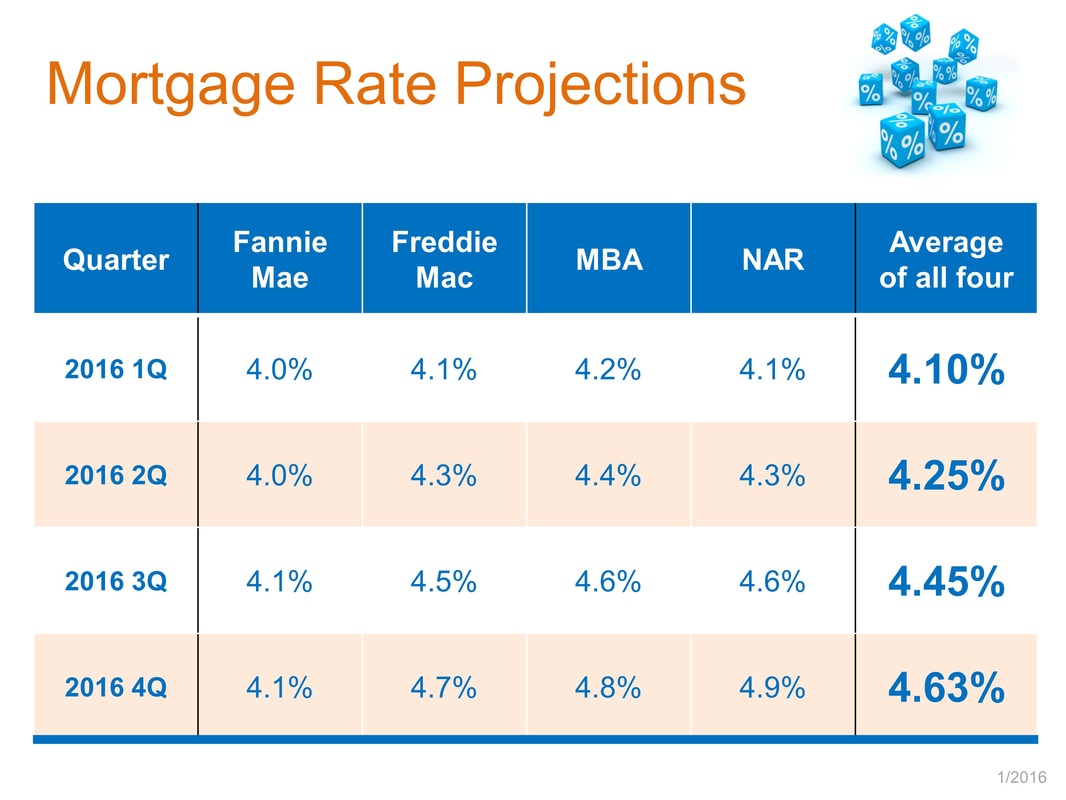

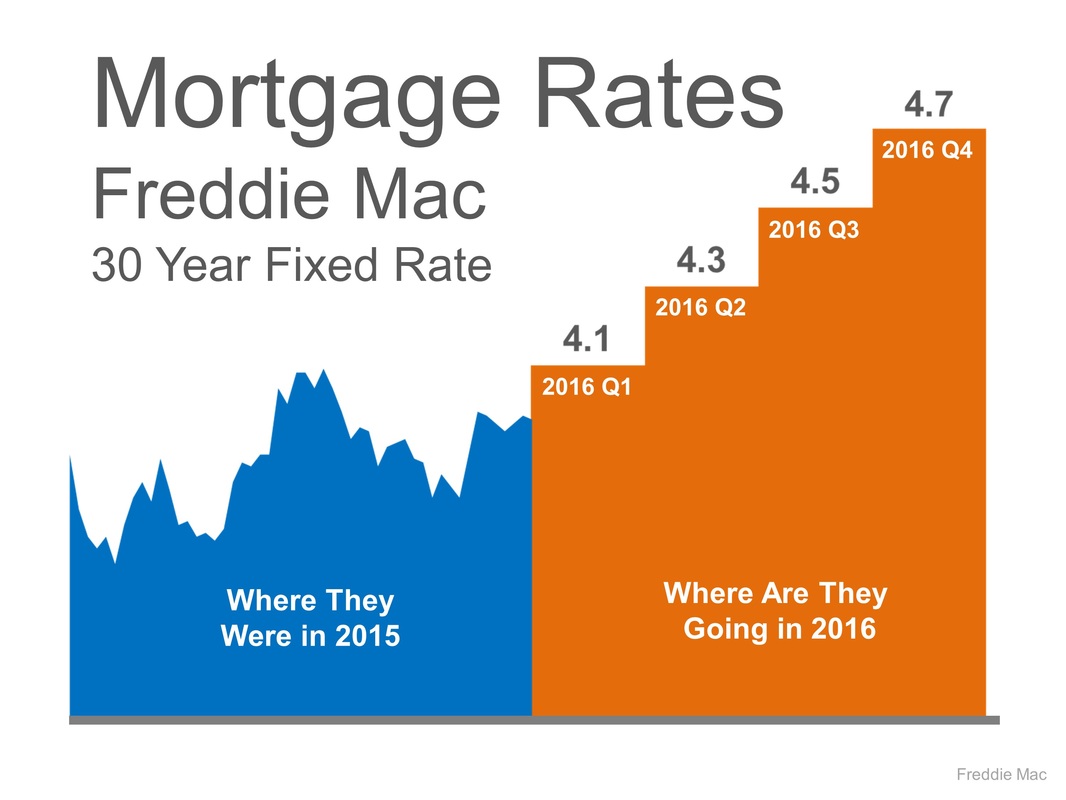

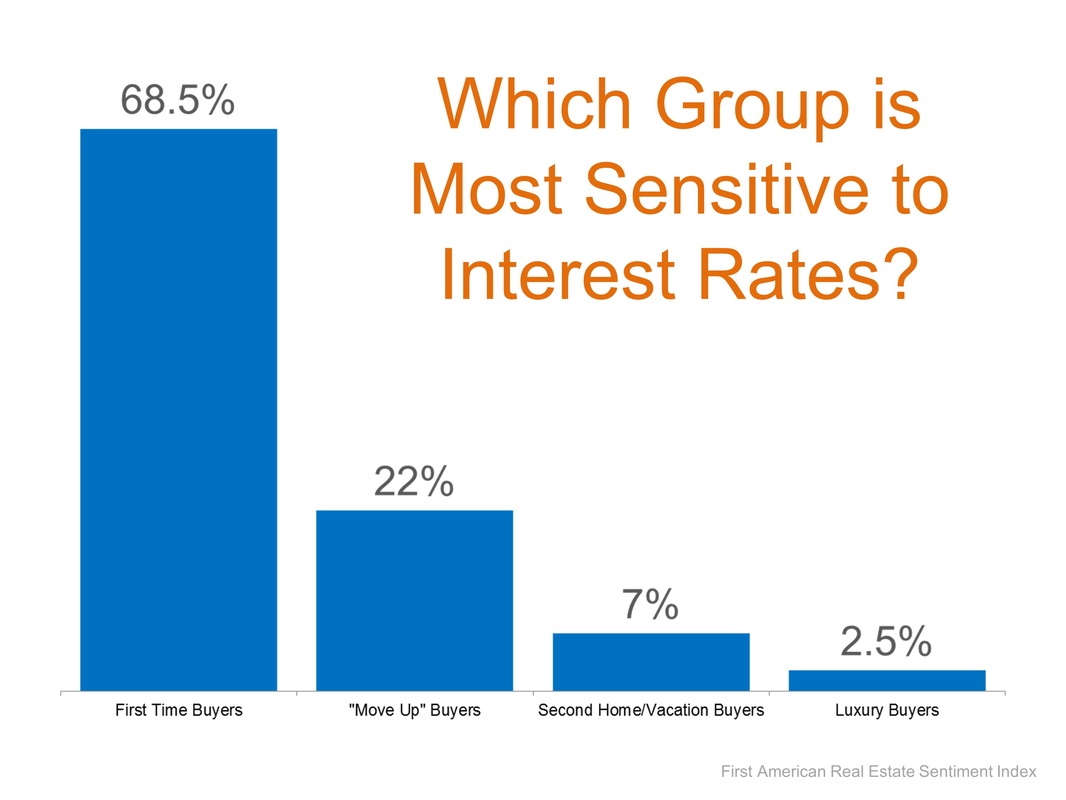

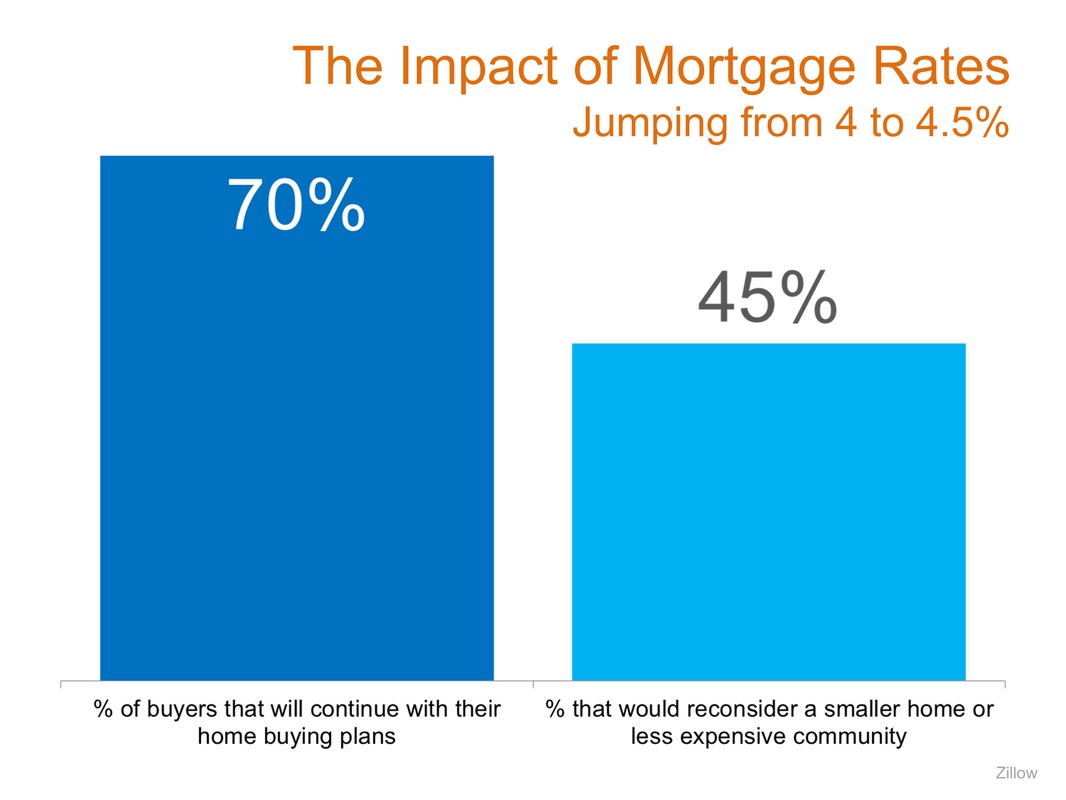

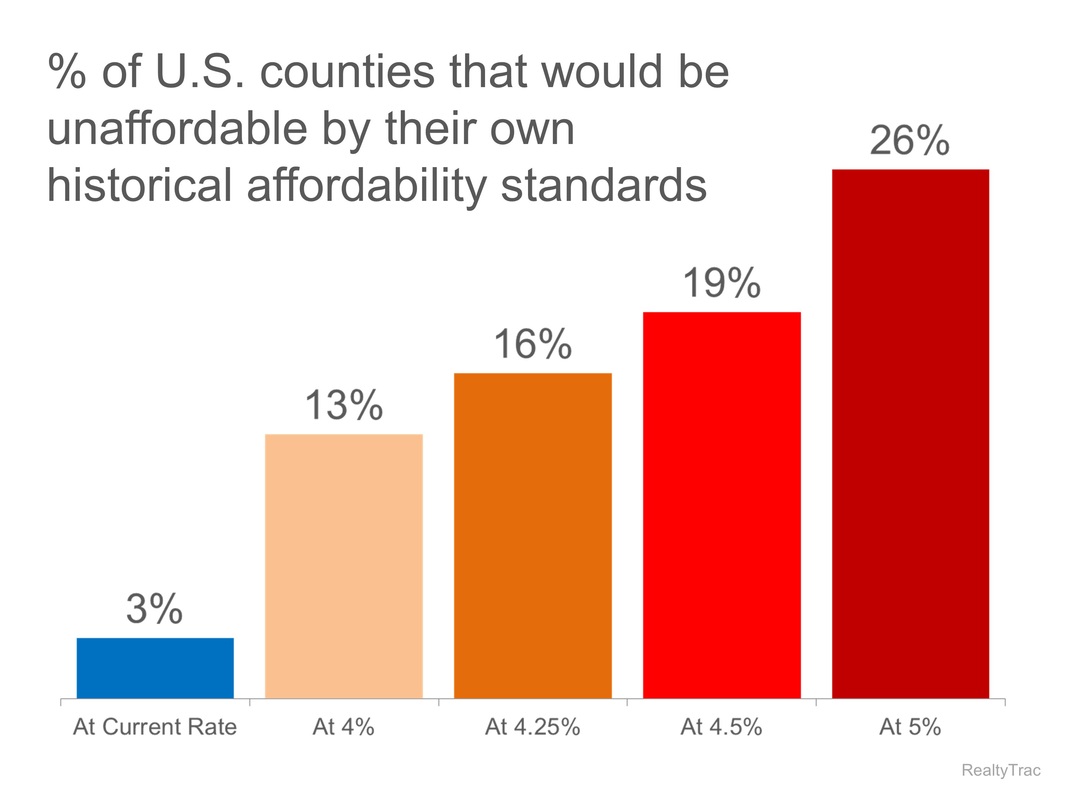

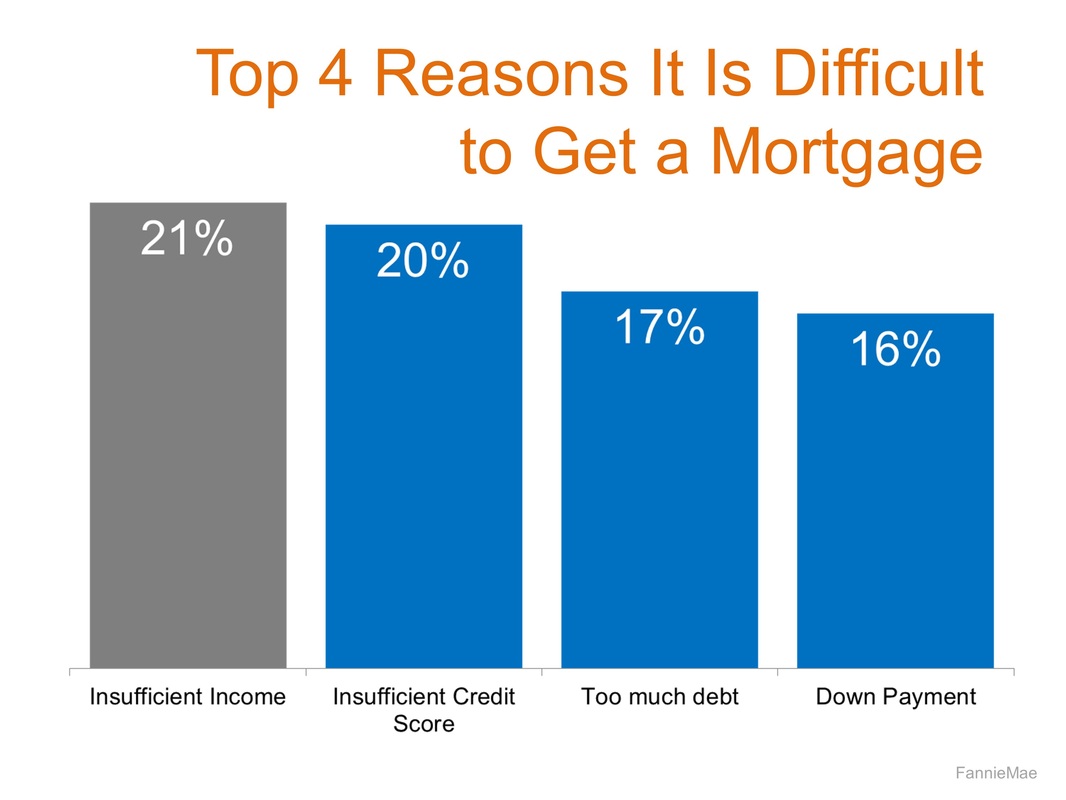

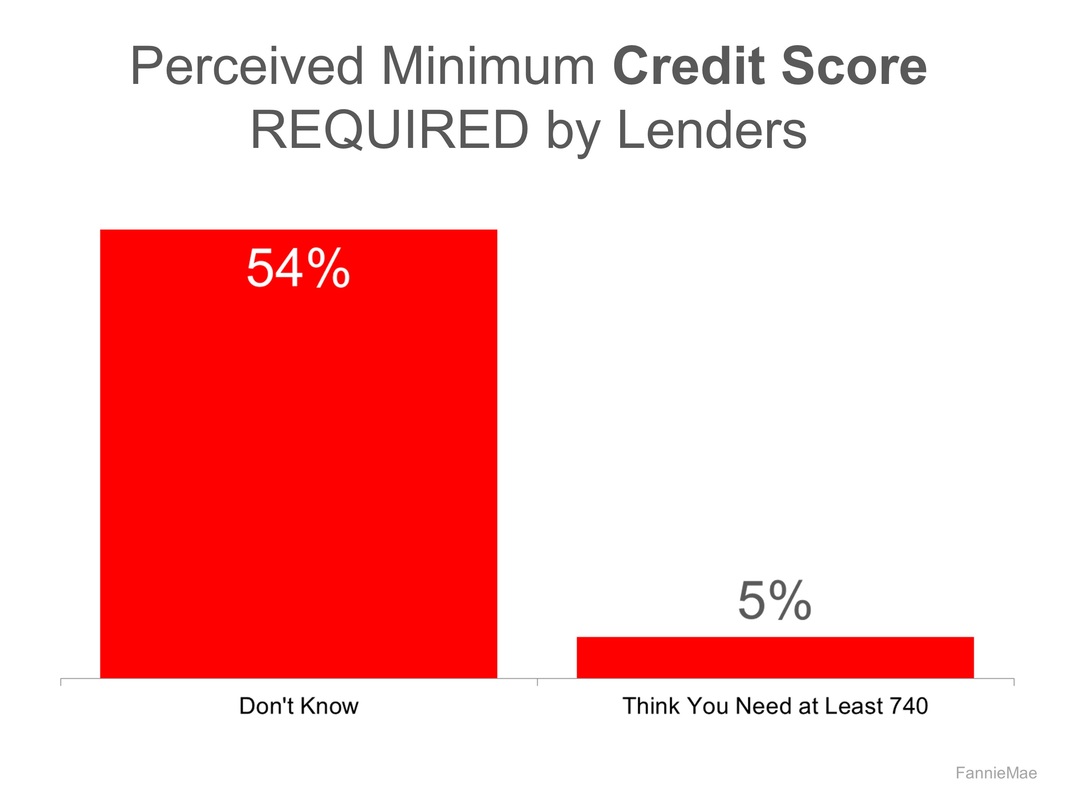

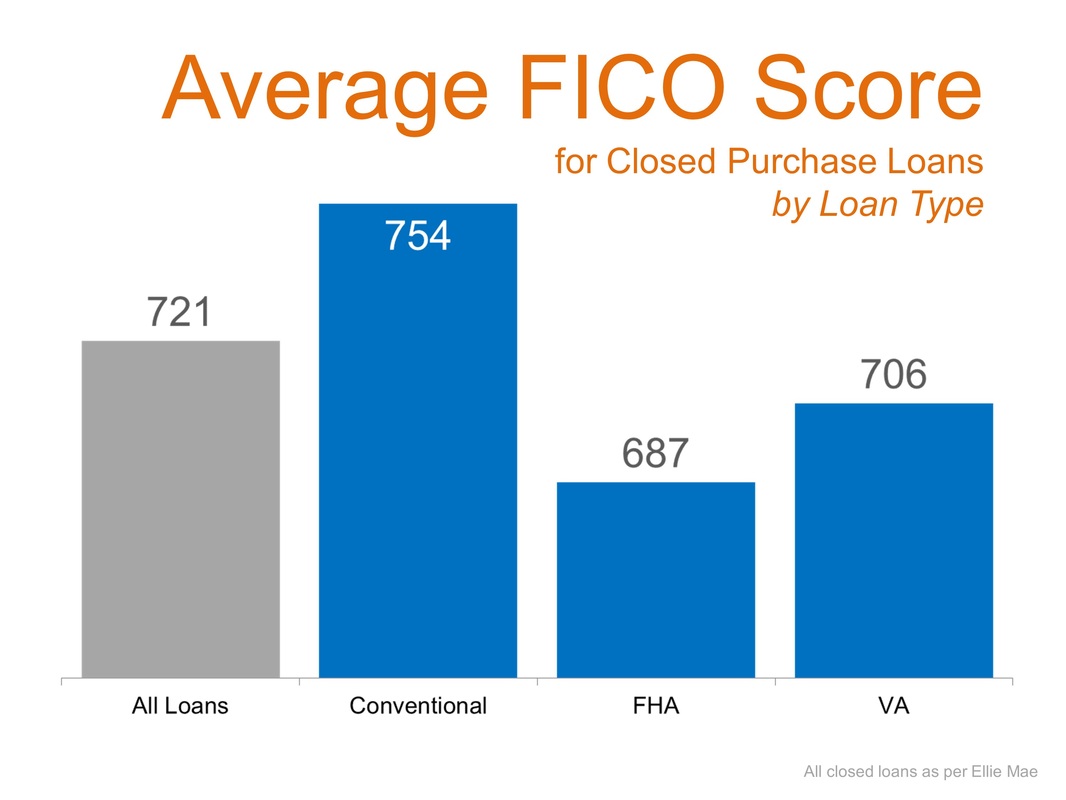

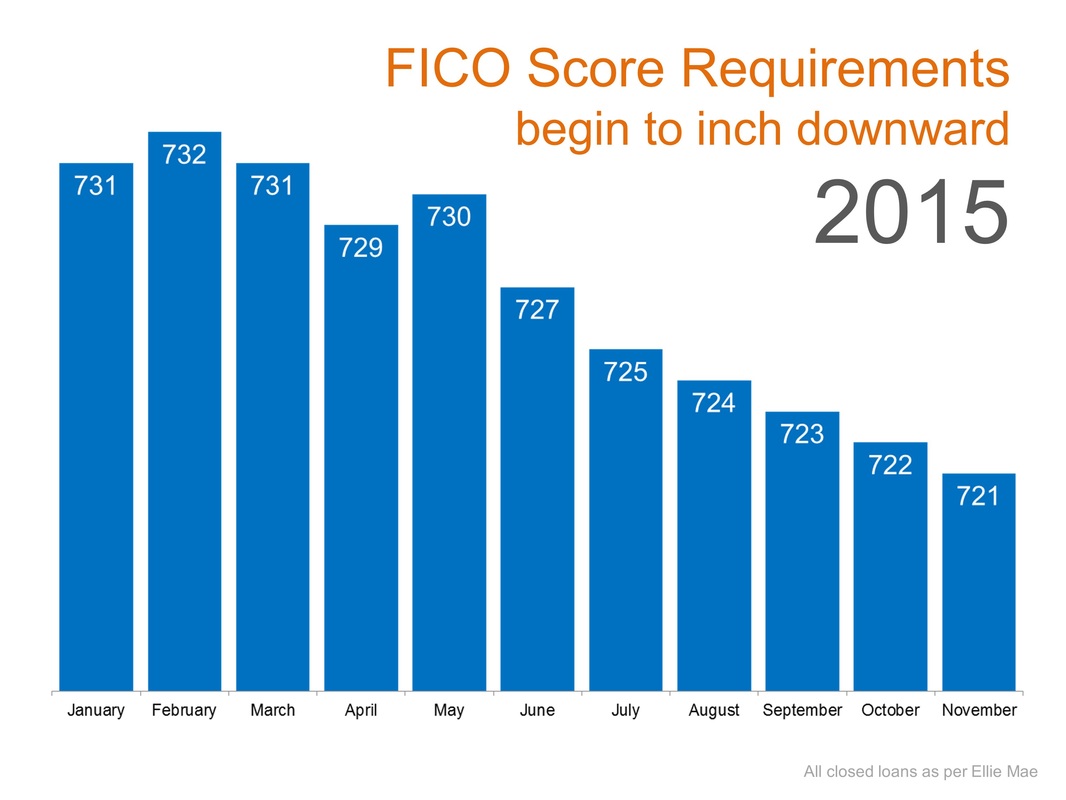

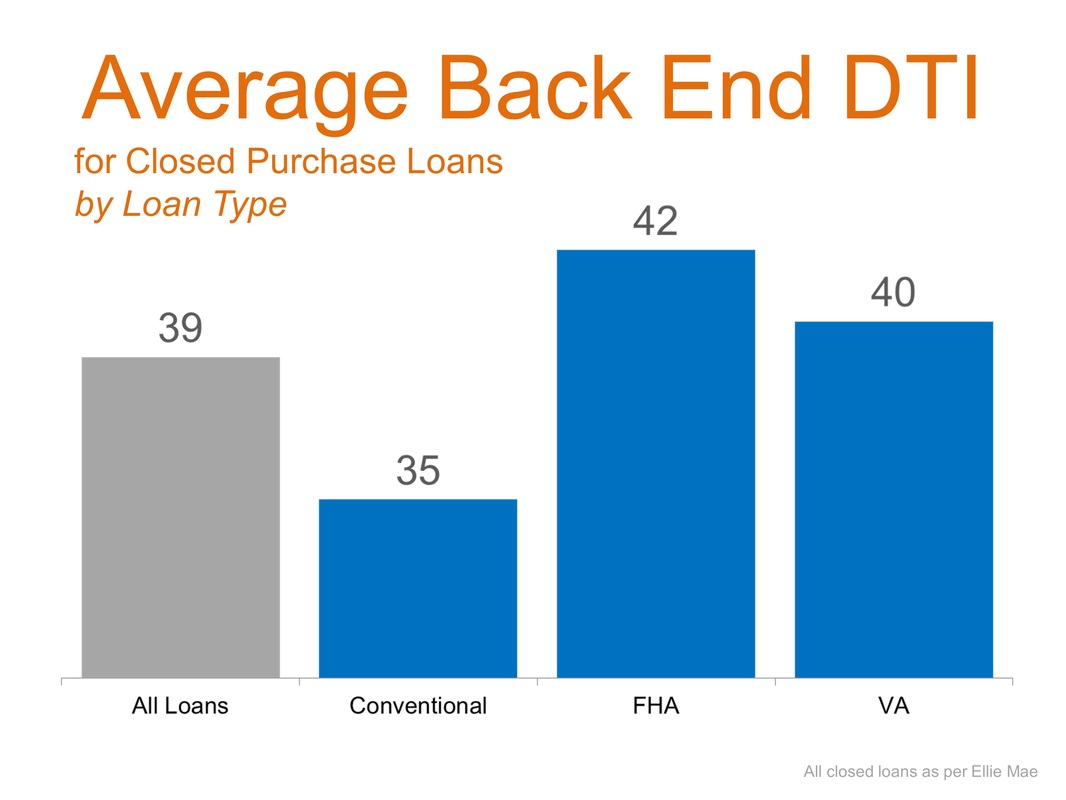

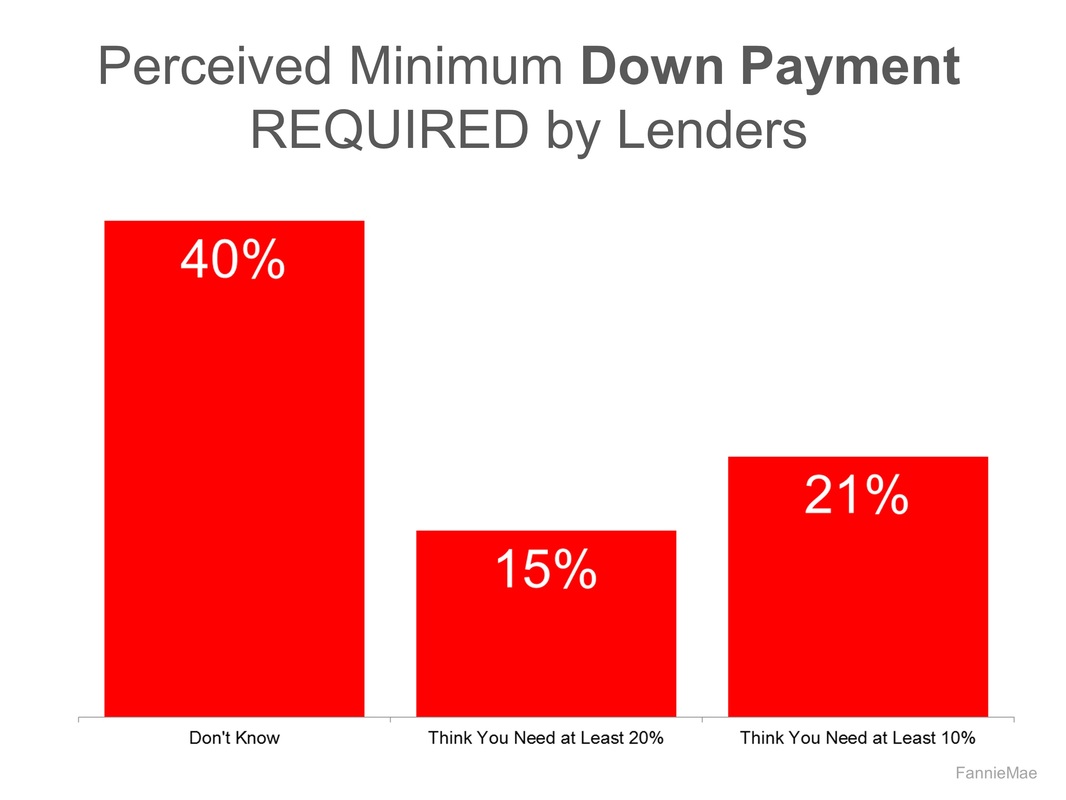

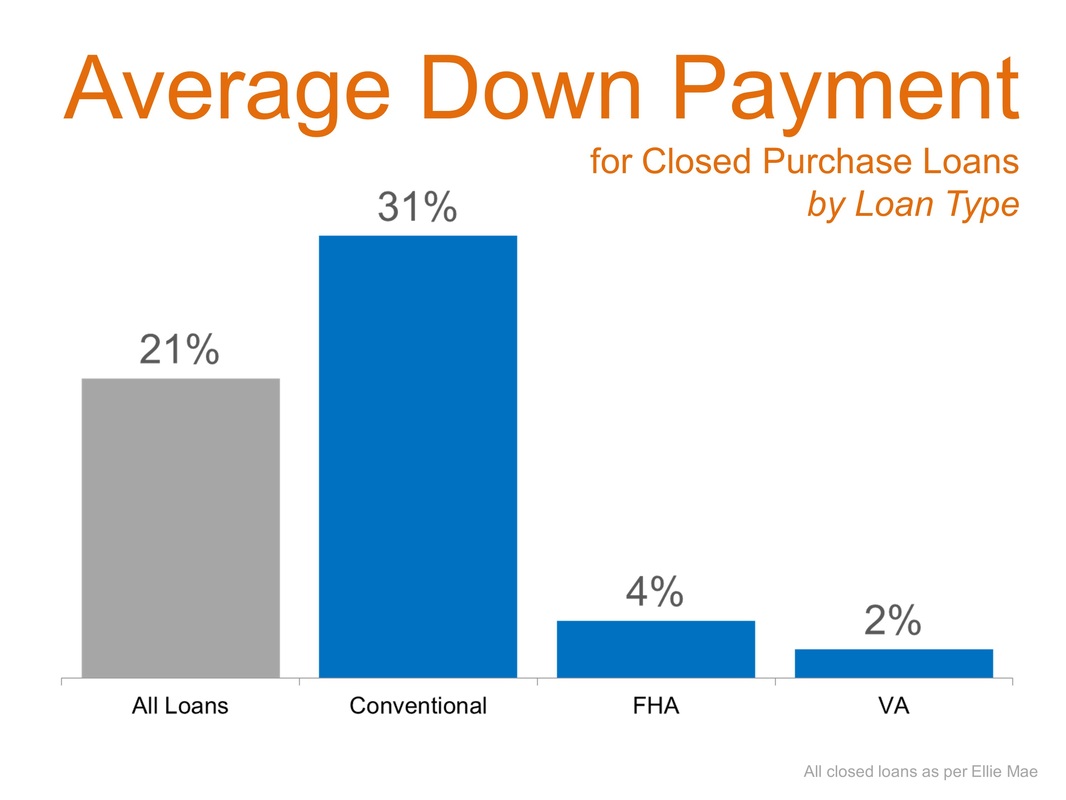

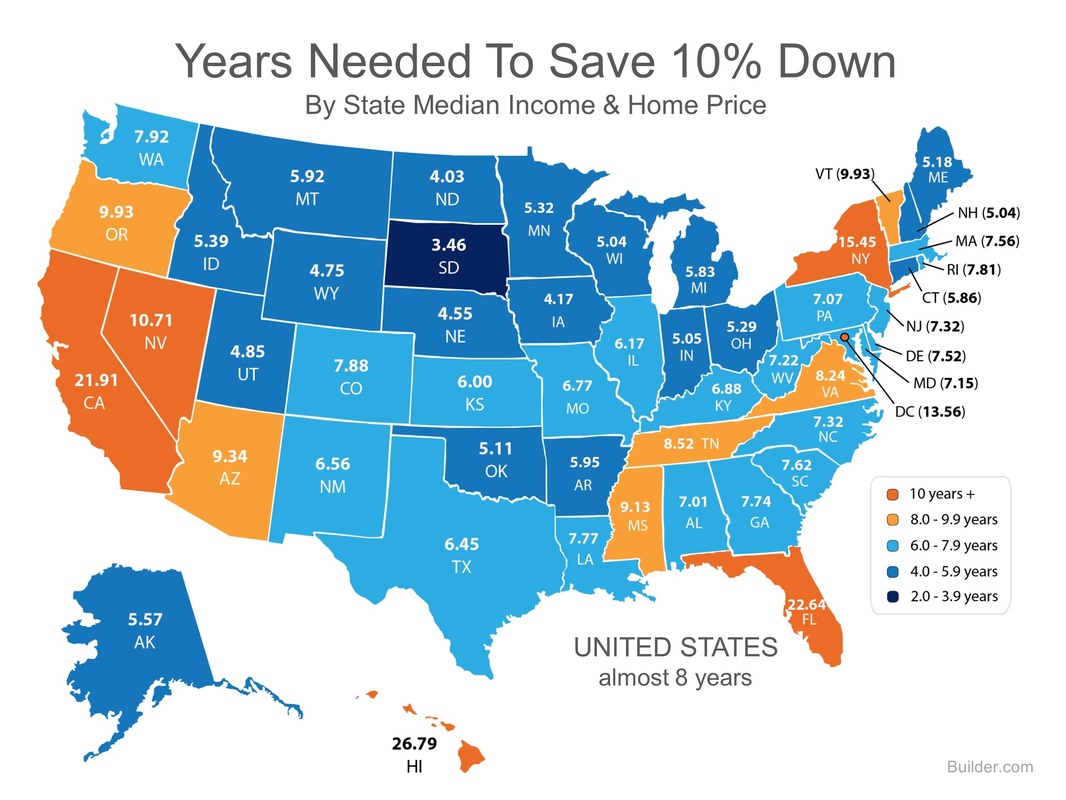

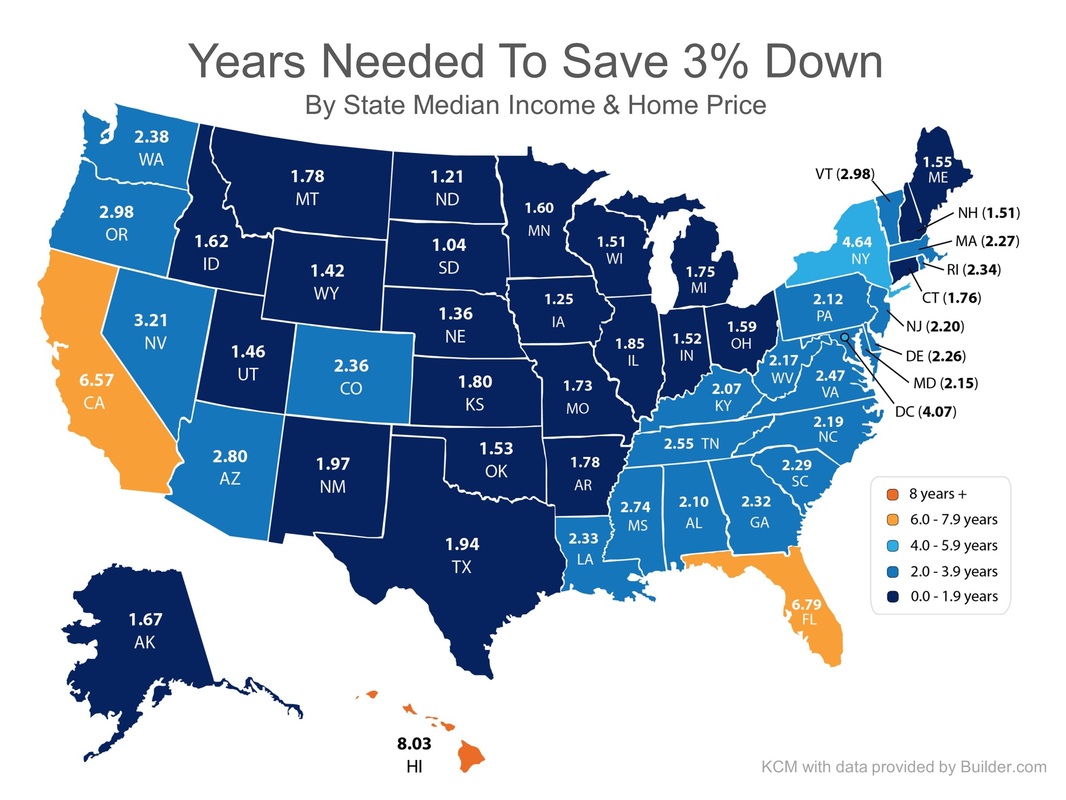

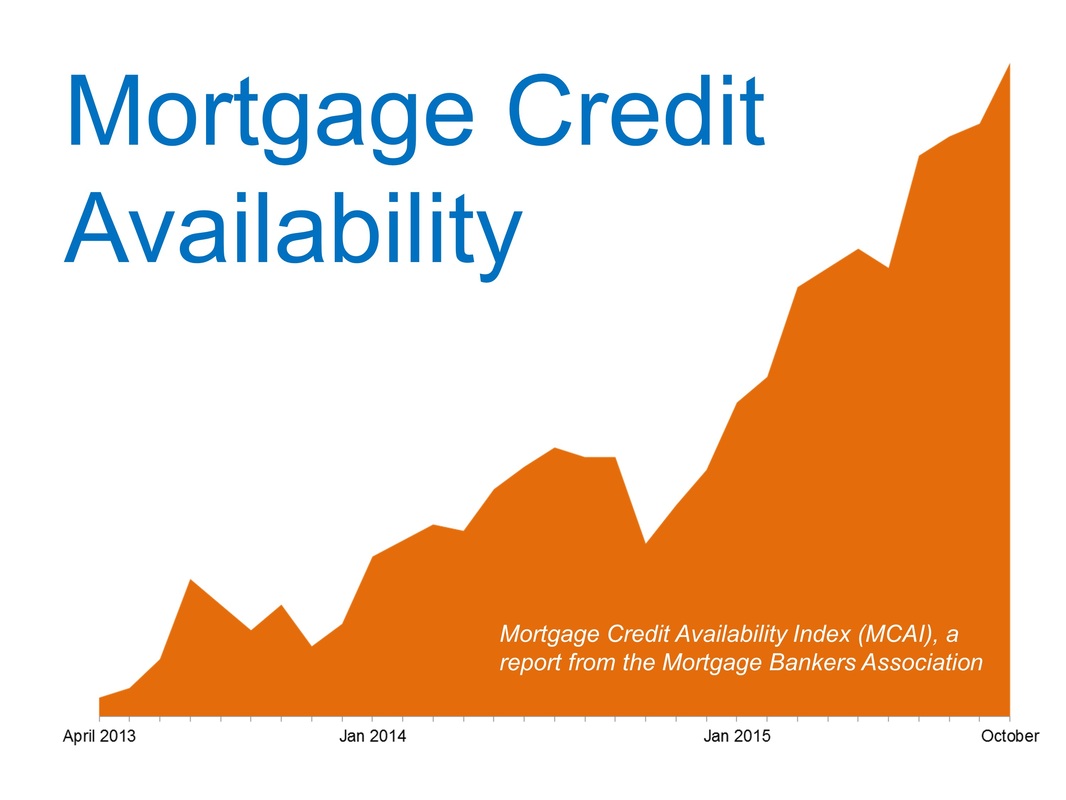

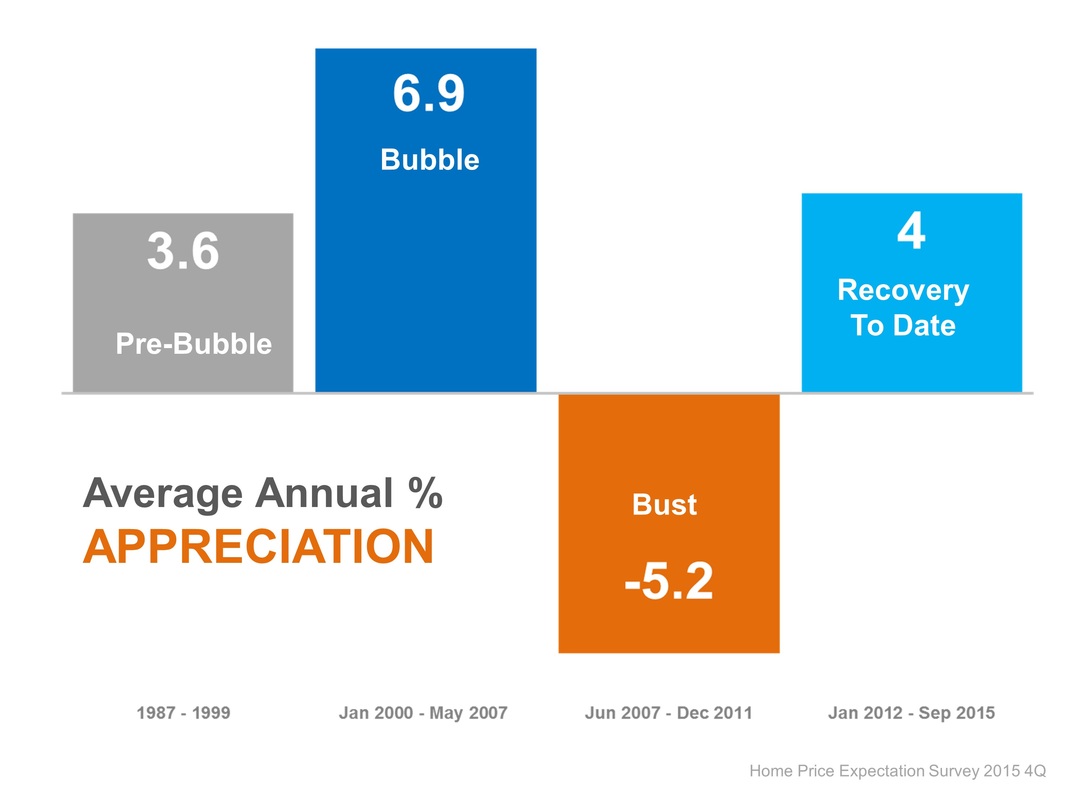

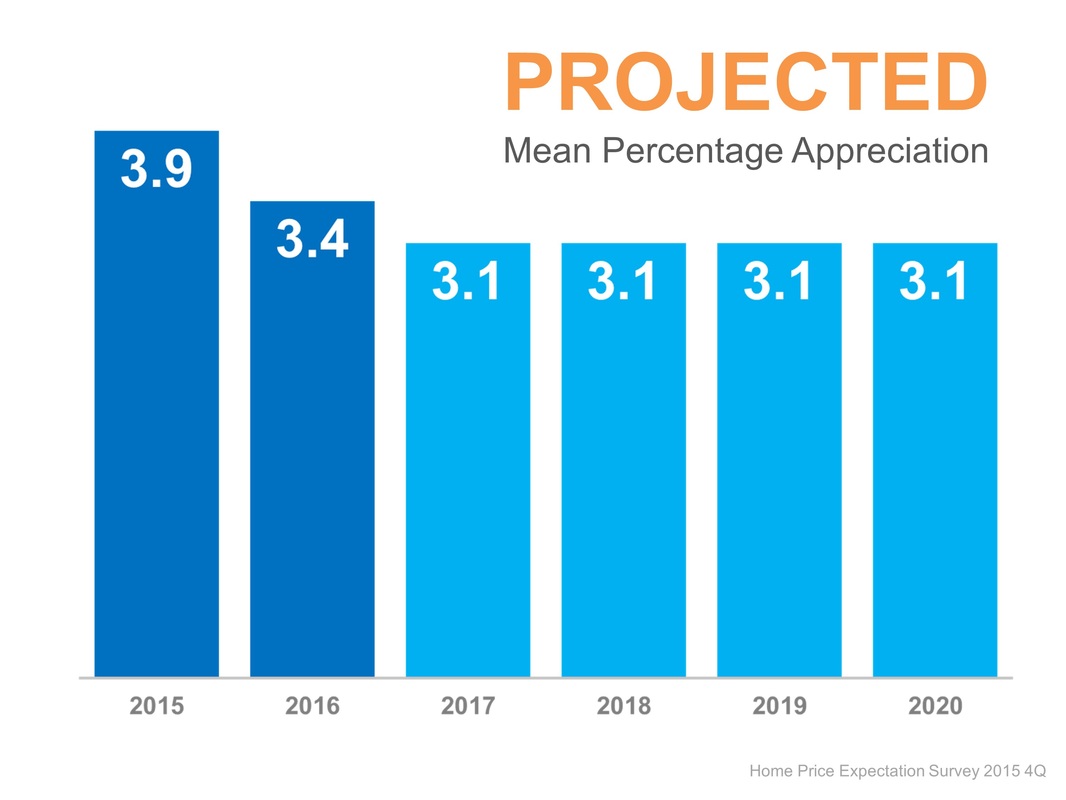

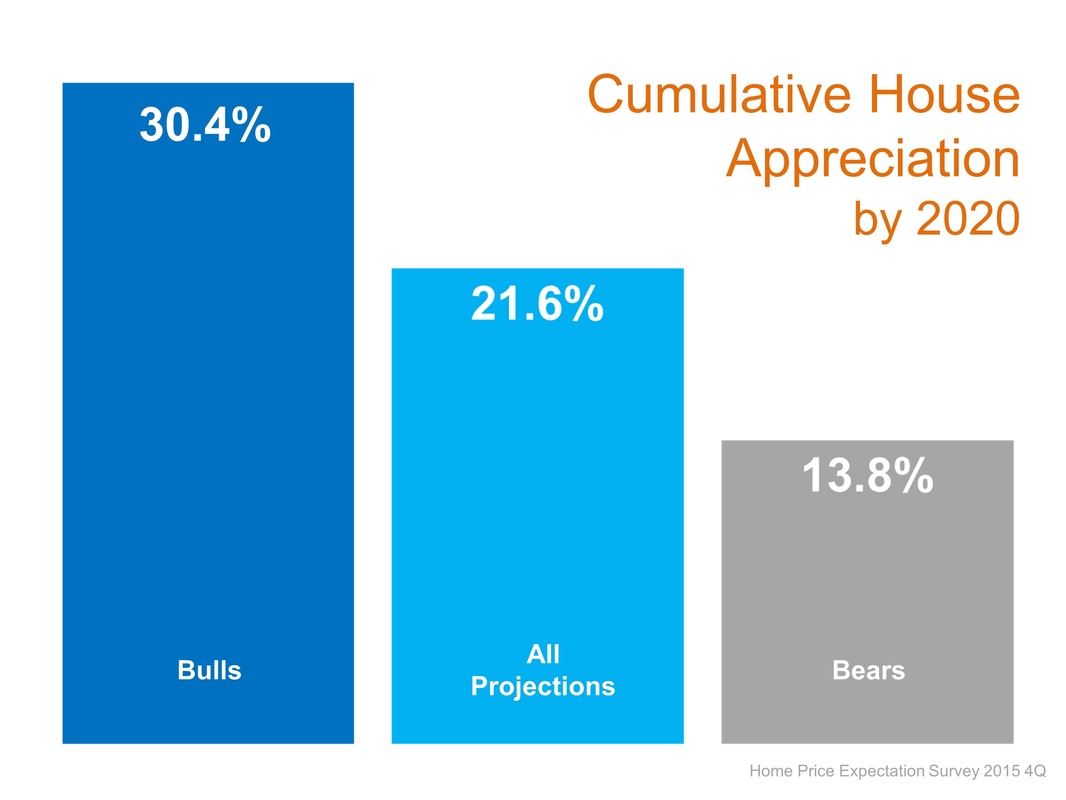

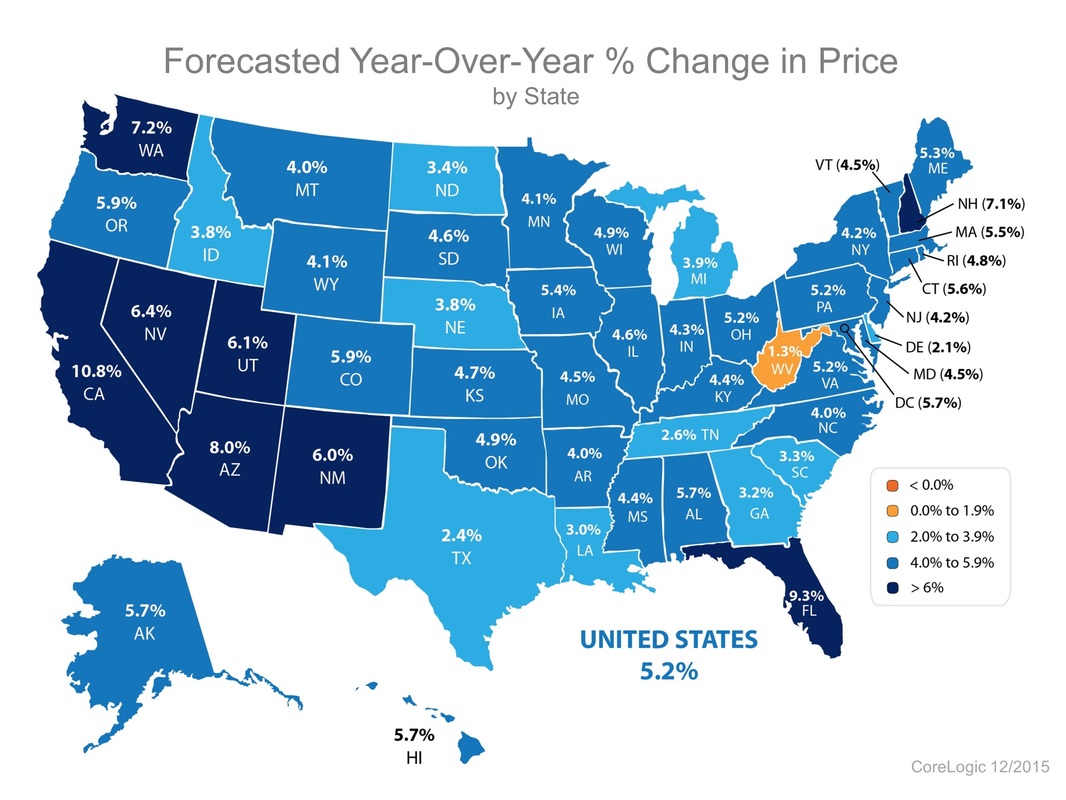

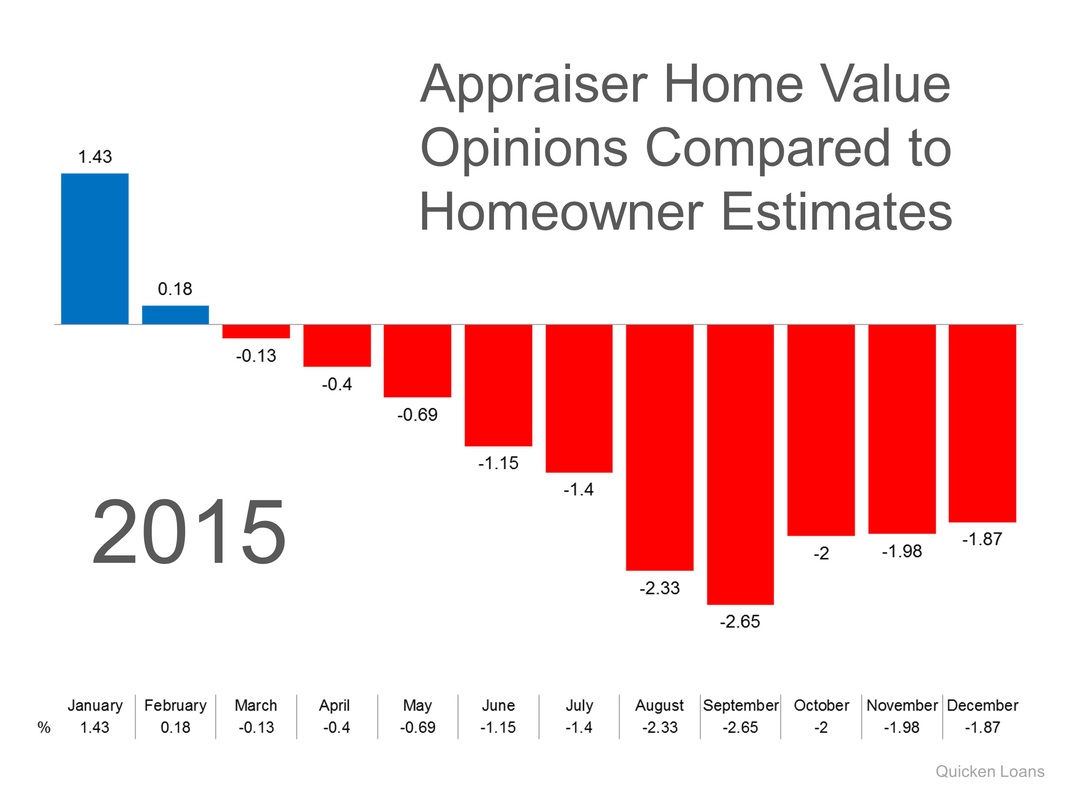

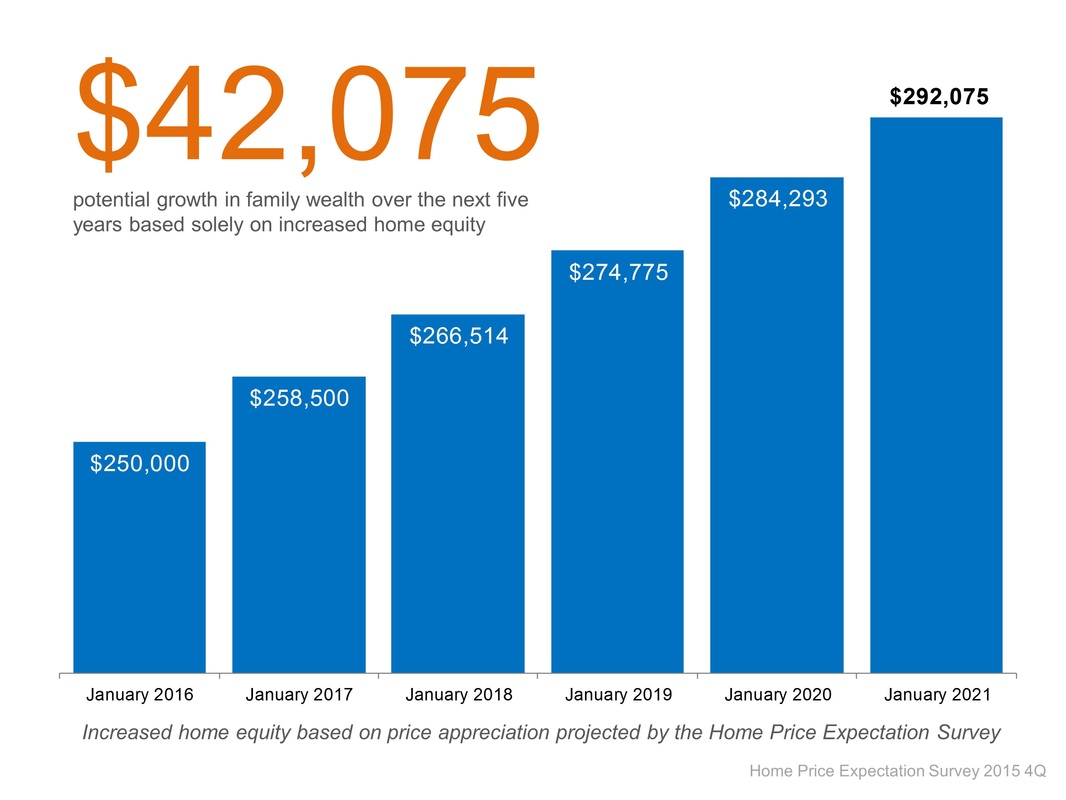

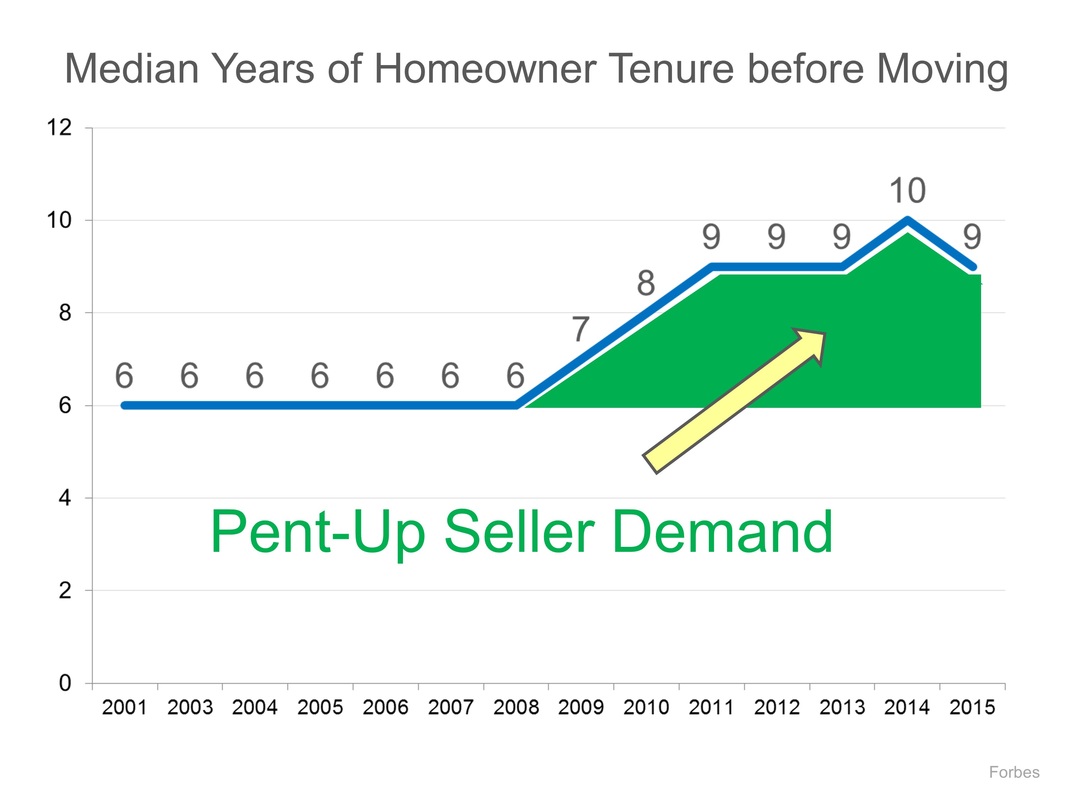

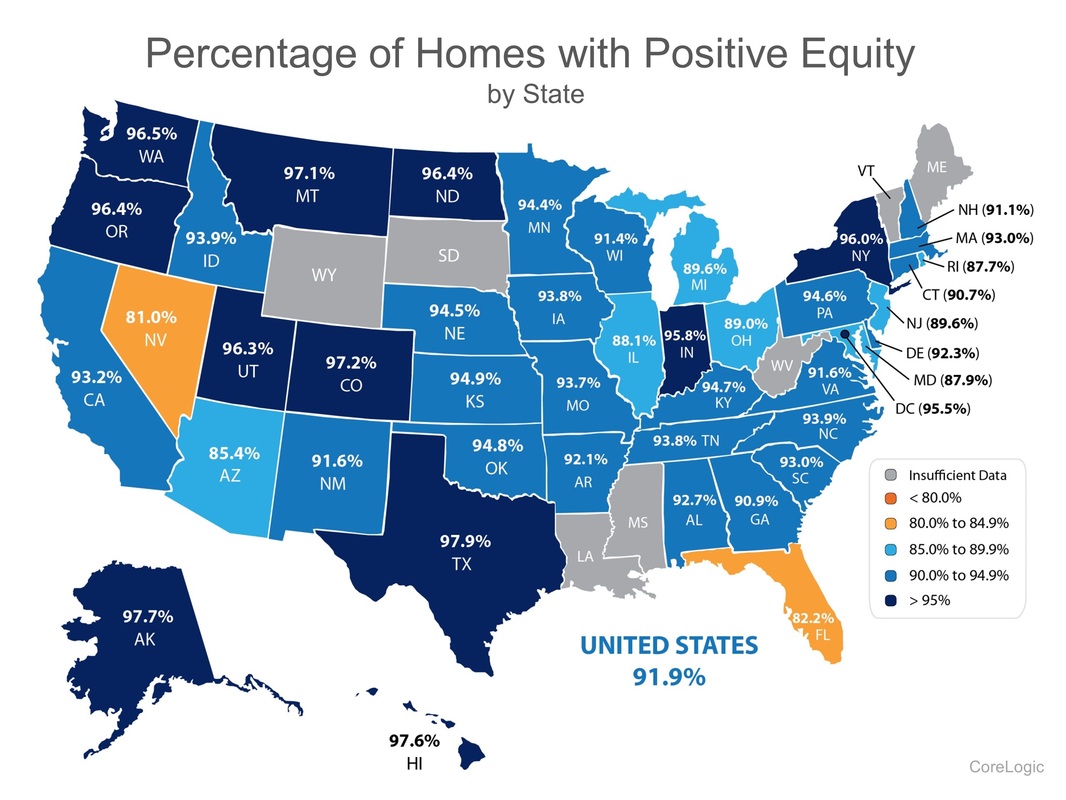

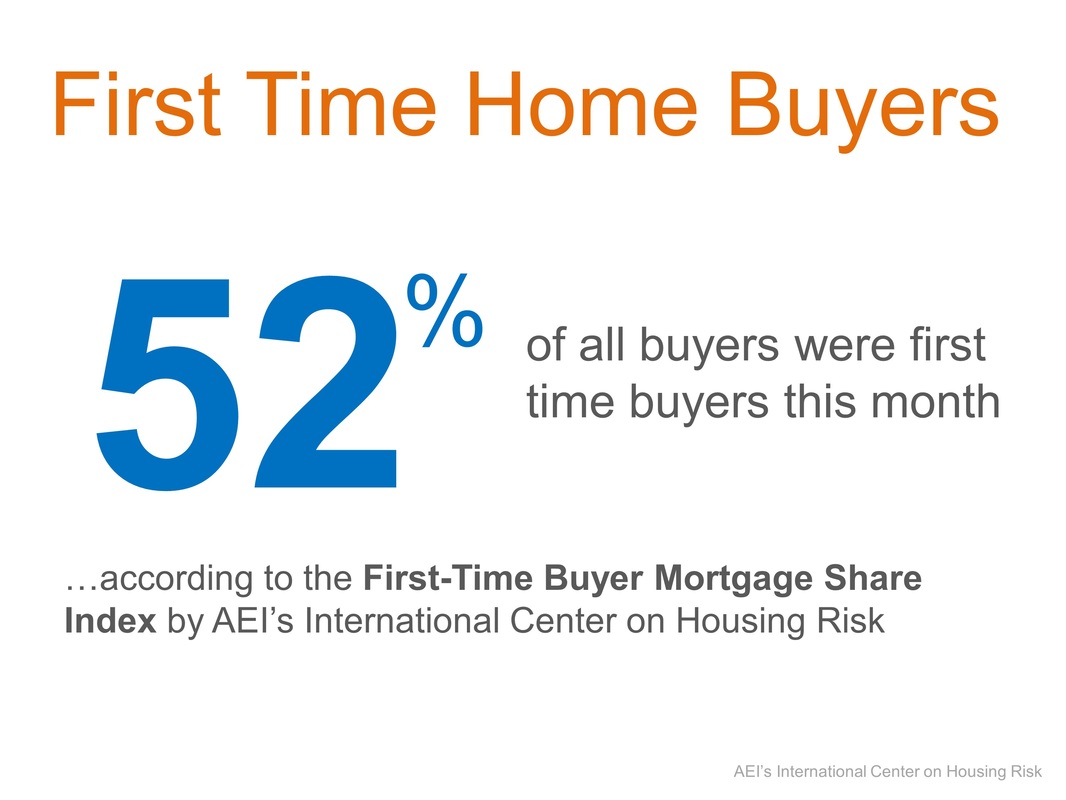

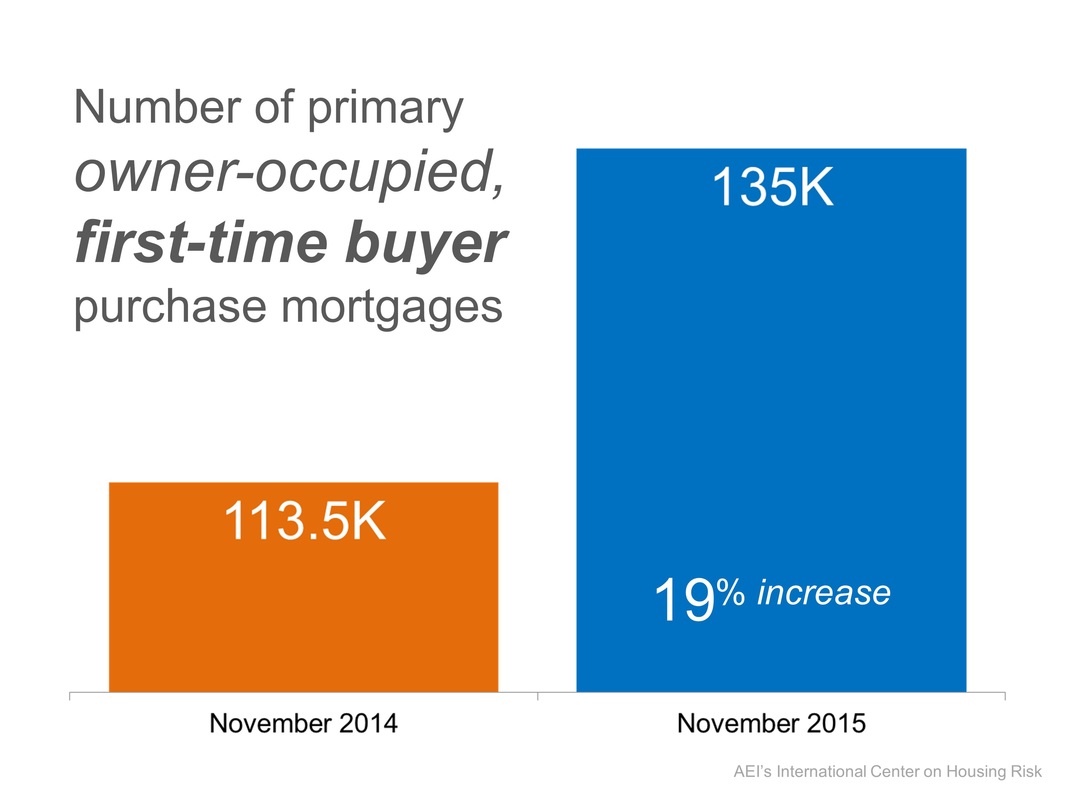

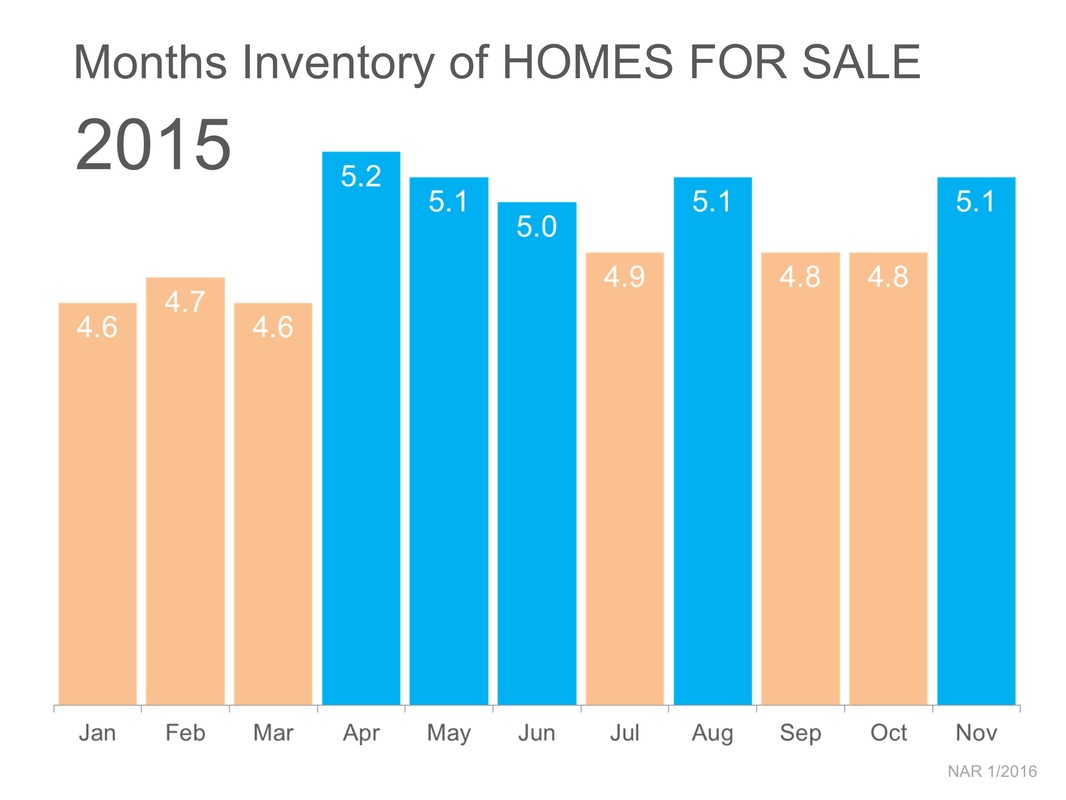

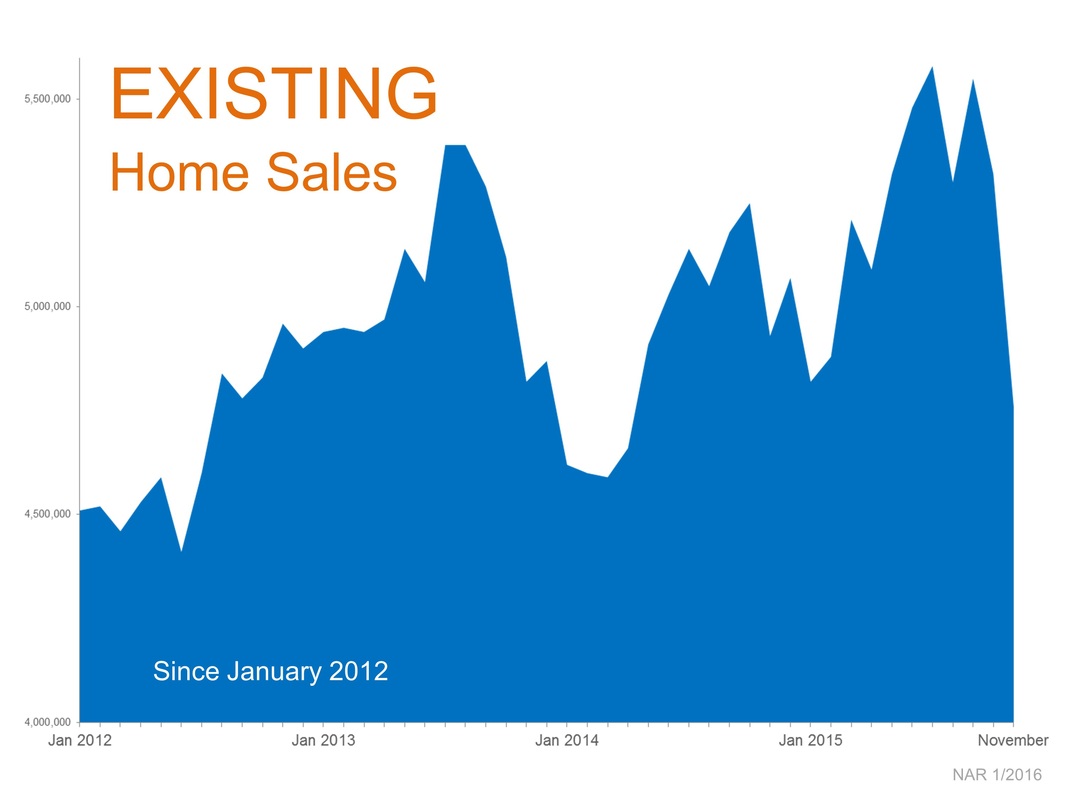

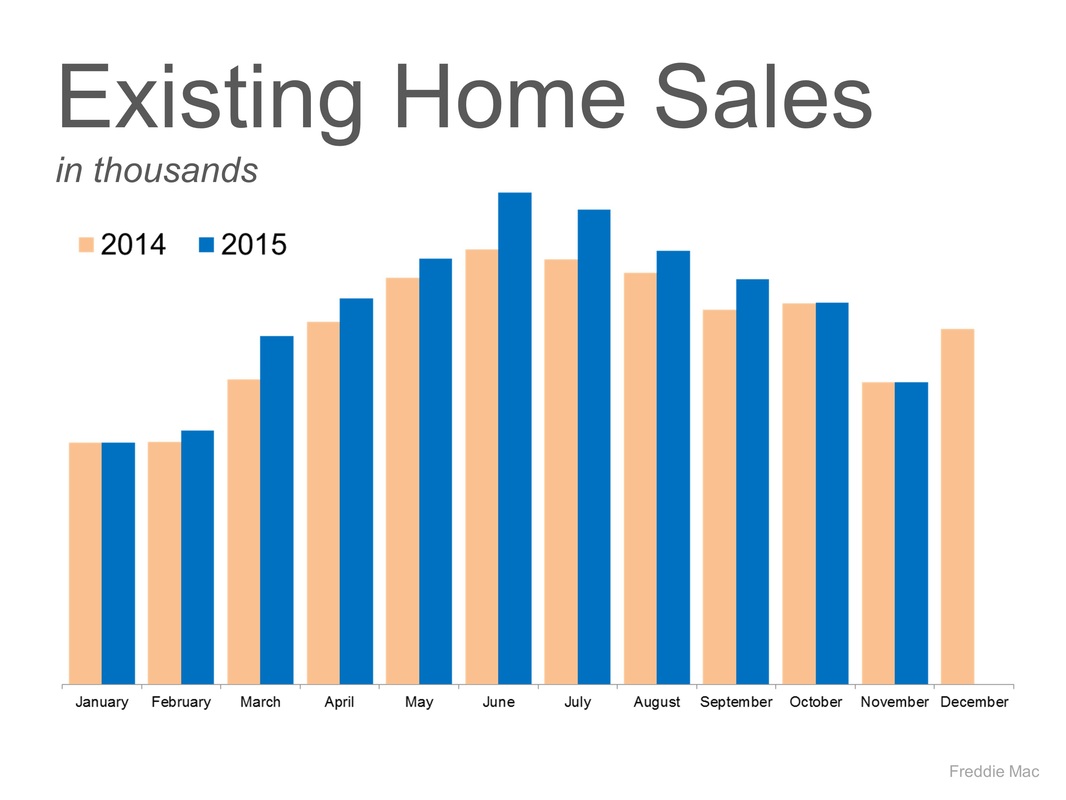

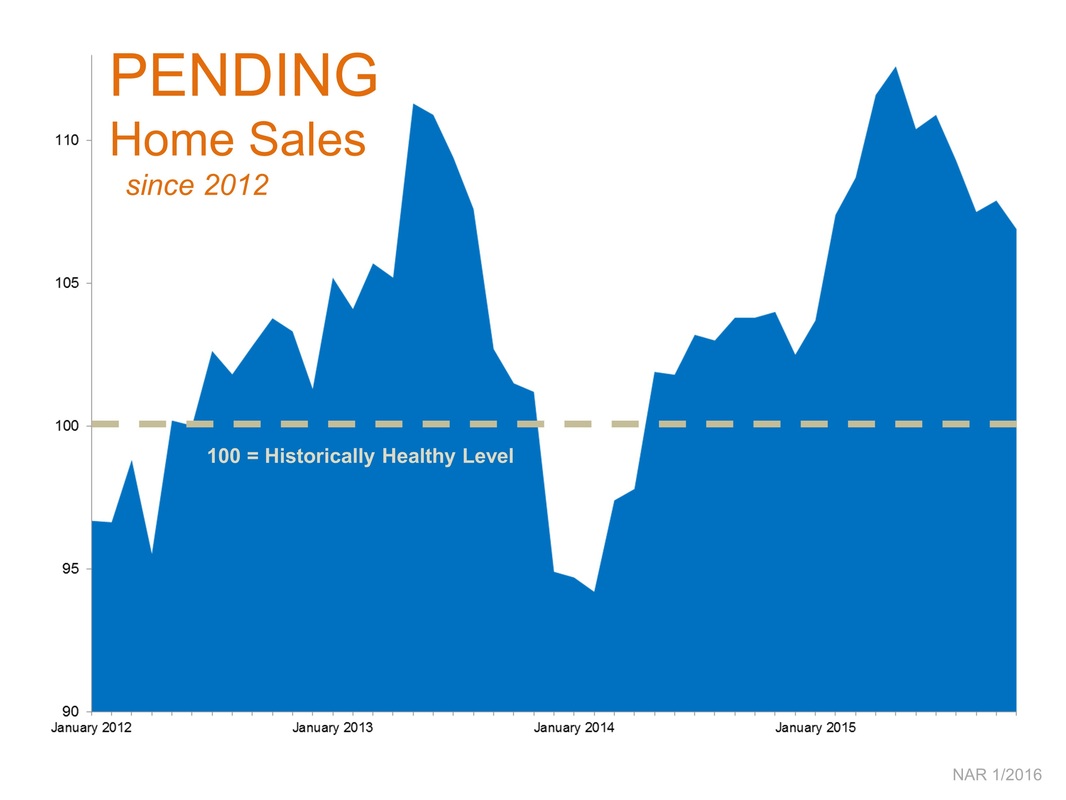

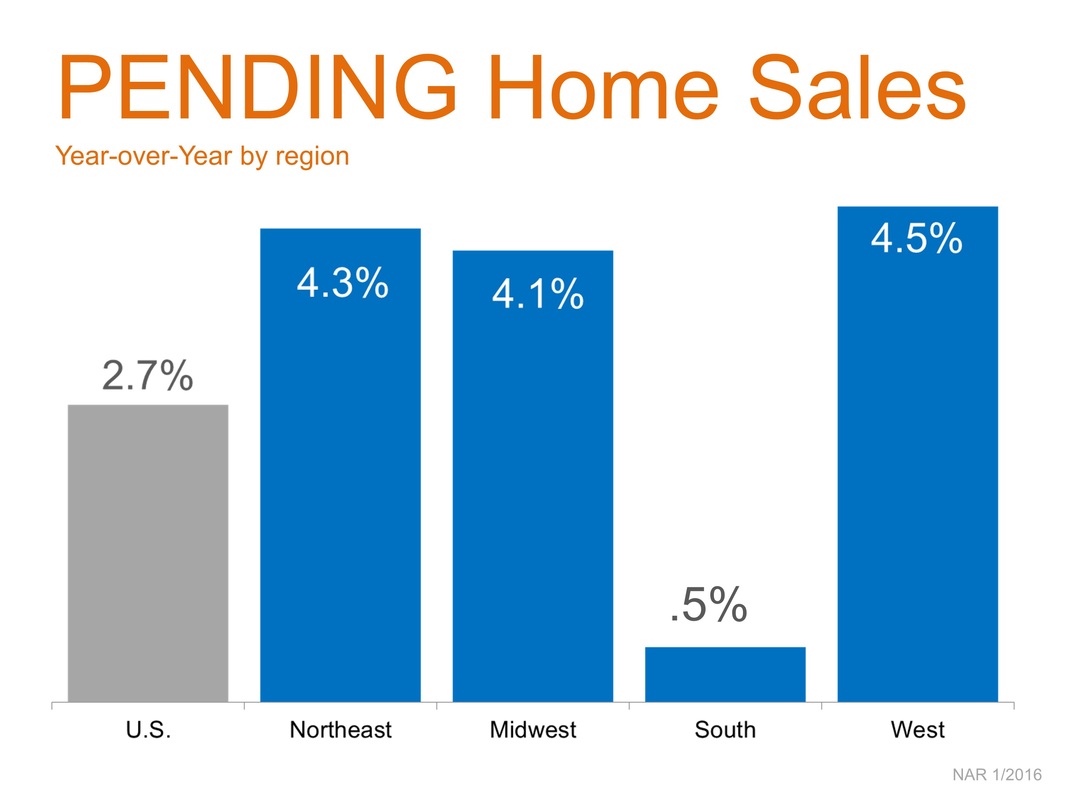

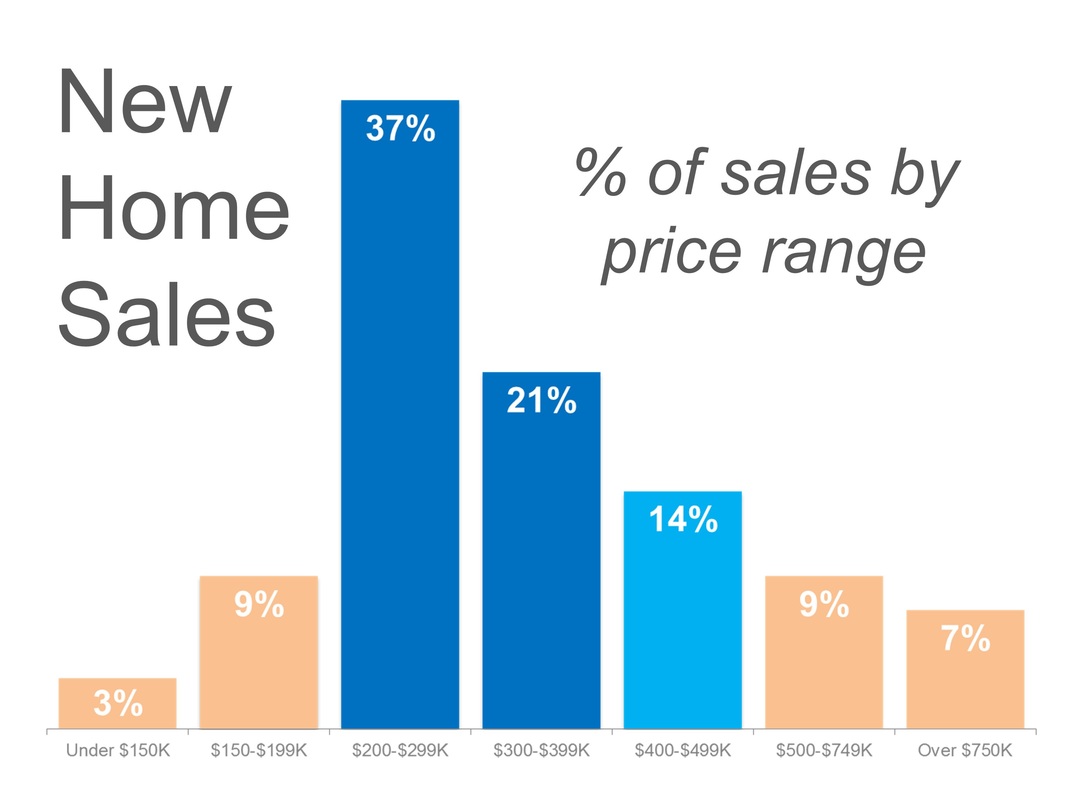

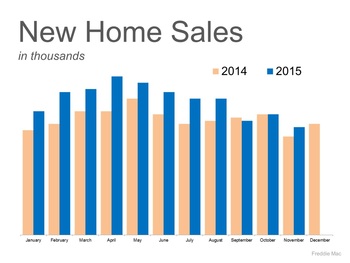

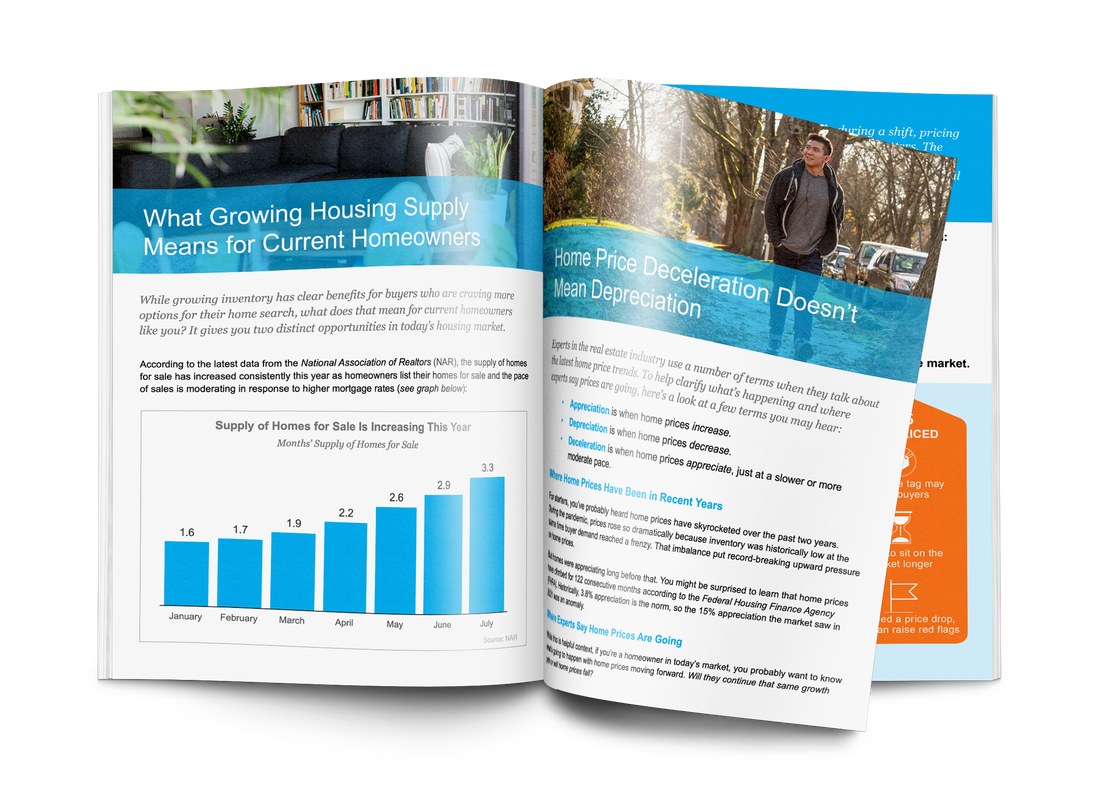

by Michael Ertem Existing home sales declined substantially across most of the nation. Outside of the Northeast, the year‐over‐year numbers were pretty dismal. We must understand there is a reason behind that. There was a new regulation called TRID (TILA / RESPA Integrated Disclosure Rule) that delayed the closings. It took more time for all of the mortgage and banking entities to get accustomed to dealing with the paperwork of the new requirements. So what wound up happening? If we take a look at the average days needed to close a loan was going down over the last several months according to Ellie Mae report. However in November, that number all of a sudden skyrocketed to 49 from 46 as reported by NAR. That is an extra three days. Why do three days matter? Most closings usually happen at the end of the month. November numbers were weak because of the lost days. If they did close in a typical 46‐day period, home sales in November would have been fine. It was this delay that caused that challenge, and I believe we will see that correct itself over the next couple of months. We see an improvement already. New home sales annualized in the thousands improved pretty nicely in November. Let’s take a look at the number of home sales, January through November in the millions, going all the way back to 2006, prime year, over six million, but so far this year, we’ve beaten every year since then. So we did not close 2015 in a bad way as a matter fact it was the best year ‐ through November ‐ we had all the way back to 2006, nine years ago. Foot traffic, the number of people out looking at houses, was grown month over month. That means demand is increasing. If we look at the 2015 return on investment of a group of different investments, precious metals, stocks, and real estate values, has increased and real estate given a better return on investment than others. Silver, gold, the Dow Jones, and the S&P 500 all saw declines, a negative return on investment in 2015, but real estate values were up. If you took money out of another investment for the down payment bought a house in 2015, you made a good decision. And if you took it out of silver and gold investments, you made a great decision. How many do think that homeownership is a good financial decision based on age? Well, what we can see is all of U.S. households, almost nine out of ten, believe that homeownership is a good financial decision. If we break it down by age, we can see that even Millennials, 34 and under, 8 out of 10 believe that homeownership is a good financial decision. Contrary to what some people are reporting that millennials don’t believe in homeownership, they do, and they understand that it’s a good decision Homeownership is part of the American dream. Do people think that homeownership is part of their American dream? Well, according to the home report by NAR, no matter what price range you’re in, the vast majority of people believe that homeownership is part of the American dream; either they strongly agree or moderately agree. If we look beyond the top numbers, in every single price point, more than eight out of ten people believe it’s part of the American dream. What we do for a living is we help people’s dreams come true. We don’t list and sell houses. That’s how we do it; that’s not what we do. What we do is help people to home ownership, and the vast majority of those people think it’s part of the American dream. The most appealing aspects of homeownership were according to the Joint Center for Housing Studies at Harvard University study is a place to raise your family. 26% said "just owning a place of your own," "you have your own castle." 14% think it’s a nest egg for retirement. 13% feel that it’s financial security for right now. 8% is being part of a community. 4% just like the fact that it’s settling down. Why do homeowners purchase a home? It’s usually a life‐changing event. 35%, lifestyle; they got married, having a child, retirement. 18% decide to settle down in one location. 15%, improvement in a financial situation; they’re making more money. As they’re making more money, they have more confidence to buy bigger things, and very obviously a home is a big investment. And probably another big thing that will keep on growing, this last column, is better and more stable job. As the employment gets better and people feel more confident in their job and the money they’re making, they’re going to be more prone to lean toward homeownership and purchase a home. Trulia also did an independent study that of all Americans, the number that believes homeownership is part of achieving their personal American dream has increased substantially from 70% to 75% over the last several years. Millennials, 18‐ to 34‐year‐olds, has grown dramatically from 65% to 80%. Eight out of ten millennials now believe that achieving homeownership is a part of achieving their personal American dream. Not that homeownership is the American dream; it’s their American dream. Now, are there some things that are concerning to homebuyers? Sure. Let’s go over those. The three biggest challenges that homebuyers have is number one, low inventory; number two, saving for a down payment; number three, rising mortgage rates. December’s numbers are not in yet, so the first 11 months of housing supply compared to last year. Eight of those 11 months, we were below the same numbers that we had last year, so even though demand is increasing, supply is decreasing. We’re not keeping up with that demand, and that’s going to cause us challenges moving forward. Part of the reason, The percentage of distressed property home sales is falling dramatically. There are fewer foreclosures and short sales. That’s all great news because the market’s straightening out. The foreclosure inventory by the state is down dramatically, in some states, definitely, the pre‐crisis numbers. Low inventory is probably holding down sales in many areas. A lack of housing inventory continues to drive developments in the market. As demands have slowly recovered, low inventory levels have weighed on home sales and put pressure on house prices. According to Frank Nothaft, chief economist for CoreLogic, many markets have experienced a low inventory of homes for sale along with strong buyer demand which is sustaining upward pressure on home prices. These conditions are likely to persist as we enter 2016. Doug Duncan, chief economist at Fannie Mae, said that several factors point to constrained housing affordability in 2016, particularly for first‐time buyers, including slow single‐family supply response and limited inventory of starter homes on the market. And Lawrence Yun, chief economist at NAR said sparse inventory and affordability issues continue to prevent a large pool of buyers’ ability to buy, which is holding back sales. Let’s jump over to rising mortgage rates. Freddie Mac, the Mortgage Bankers Association and the National Association of Realtors predict that by the fourth quarter of 2016 interest rates look like they’re going to be up almost a full percentage point, or, at least, three‐quarters of a percentage point. Fannie Mae is saying that by the end of the year interest rates are going to be pretty much where they are right now, and the other three disagree. If we want a real strong visual on it, let’s take a look at Freddie Mac, their mortgage rates. Where they were in 2015 and where they project they’re going to head in 2016, and we can see there’s a dramatic difference between the two. 2016 is the year the Fed decided to hit the Fed rate that mortgage rates are going to start slowly going up. Who’s going to be most affected? 68.5% said it’d be first‐time homebuyers. 22% said, move‐up buyers. Then the second home or vacation buyers and luxury buyers. But first‐time homebuyers, the people that have to make that first domino in the market fall to let all the other dominos fall, almost seven out of ten will be sensitive to rate increases. That's why it is imperative that first time home buyers need to act sooner than later. What type of impact? Well, according to Zillow, 70% of the people they surveyed will continue with their home buying plans. What that means is, 30% are going to change their plans. Some are going to decide not to buy if interest rates jump to 4.5. Forty‐five percent said that they would consider a smaller home or less expensive home, community, so they’re not going to turn around and not buy, but they’re going to scale down their expectations. RealtyTrac did a study, and they talked about the percentage of U.S. counties that would be unaffordable by their historical affordability standards. At the current rate, only 3% are above the historical affordability standards. But as interest rates rise, the percentage of counties in this country that will now be above the historical affordability standards will increase dramatically. Due to the strength of the economy, which will counteract some of the rises in interest rates. We will project a 10% growth in purchase market in 2016 despite steady increasing rates. Mike Fratantoni, MBA’s chief economist, said overall, mortgage origination volume will be down next year due to a reduction of refinances, but the positive impact of the improving economy on home purchases will offset the reduction. Fewer people are going to refinance because more people are going to say, hey, listen, this is cool. Fewer people are going to fix their house up through a refinance, and they’re going to move to the new house. Now, one of the top four reasons was it’s difficult to get a mortgage. We talked about before that they were worried about saving for a down payment. Fannie Mae did a study, and all these studies are within the last 30, 45 days, and they said what is the most difficult things you see in front of you getting a mortgage. We’re not just talking about first‐time homebuyers here. I want you to understand that we’re also talking about move‐up buyers here; they have the same concerns. There’s a lack of knowledge across the board about what it takes to get a mortgage right now. 21% say insufficient income, and let’s assume that’s true, and there’s not too much we can do about that. 20% say the most difficult thing is credit score, they don’t have a good credit score; 17% say it’s too much debt that they have; and 16% say they can’t save up for a down payment. Let’s look at those last three issues. According to the Fannie Mae survey, the perceived minimum credit score required by lenders, what people thought of that, 54% of the people they surveyed didn’t know what the minimum credit score required by lenders was, and 5% thought you needed at least 740; that’s 59% of the people either don’t know or are wrong. How do I know they’re wrong? Here are the average FICO scores by loan type in the last Ellie Mae report. The average FICO score across all loans is 721; conventional loans, 754; FHA, 687. Not 787, 687. And VA loans, 706. And we can see that the average FICO score across all loans has been dropping rather dramatically for the last several months. So now let’s not let FICO score, or what you perceive to be the necessary FICO score, stand in the way of people buying houses. Make the decision to move forward and educate yourself. How about the debt‐to‐income ratio and what people think lenders require. Well, let’s take a look at it. 59% don’t even know what the required back‐end DTI should be. 25% incorrectly think that you need less than 25% as your back‐end debt, and 7% think you need less than 39%. Let’s switch over to reality, again according to Ellie Mae, all loan types, including closed purchase loans. They need a 39%, on average, back‐end DTI, not the 25% they thought they needed. Conventional loans, they need 35% back‐end DTI, 42% on FHA, and VA it’s 40%. Let’s jump over to minimum down payments. Well, perceived minimum down payment required by lenders, 40% don’t know what down payment is required, 15% think you need at least 20%, and 21% think you need at least 10%. So 40% don’t know, and 36% have it wrong. That’s a big number; that’s more than three‐quarters of the people either don’t know or think incorrectly what they need as a down payment because the real numbers are right here. The average down payment in November for all loans is 21%, conventional loans are as much as 31%, but FHA is as little as 4%; that’s the average, 4%. And VA loans, the average VA loan closed with 2% down. Now, NAR, not talking just in November, looking into the whole year in a recent report, showed that all buyers, a typical down payment for all buyers are 10%, for repeat buyers is 14%, and for first‐time buyers is 6%. So many people don’t know what’s required to get a mortgage, and some of the people that do know are wrong. What does that mean? That means we, along with the mortgage professionals align ourselves within the industry, are not doing a good enough job of educating the public. That’s our responsibility. If we don’t do it, who is going to do it? The three most famous words were location, location, location. For the next couple of years, that’s going to change. The three most important words in real estate are going to be education, education, education. If many of the buyers or even the move‐up buyers are saying, "well, I have to make sure I either have 10% down". Look how many years it would take them to save 10% down. To buy a house in California, it takes them 21 years. To purchase a house in New York, they have to wait 15 years based on state median income and home price. If we could just get them to 3% down, and there are conventional programs available to many buyers at 3% down, look at how much they will cut back on those years. That’s what being a great real estate professional is about, giving people the information they need to make the best decisions for their family when they’re buying a home. Again, take a look at those two maps, the difference between 10% down and 3% down in the years; just save that. The Mortgage Credit Availability Index is skyrocketed. They don’t report it every single month; they missed a couple of the months. The last month they reported on was October. But we can see, if we’re going all the way back to April 2013, the availability of mortgage credit has gotten easier and easier and easier each year we went along. Fannie Mae just issued their 2015 fourth quarter Mortgage Lender Sentiment Survey. It said two things, number one, lenders continue to ease credit standards over the next three months with the net percentage of lenders reporting easing expectations, reaching a new survey high. It’s going to be easier to get a mortgage according to those surveyed. Number two, more lenders reported easing of credit standards than tightening them over the prior three months across all loan types, continuing a trend seen throughout the year. Every month it got easier and easier to get a mortgage. The problem is most consumers don’t know what the lending trend is. Let’s move away from the mortgaging although I think that’s a big issue going into 2016, education and the mortgage requirements, let’s jump over to the real estate side. Look at this chart by Home Price Expectation Survey (a survey by the nationwide panel of over 100 economists, real estate experts, and investment and market strategists). To give you a little historical context of where appreciation should be before the bubble, from 1987 to 1999, pre‐bubble, on an annual basis. Home prices went up 3.6%; during the bubble, it was 6.9%. The bust, we were losing a little bit more than 5% a year and the recovery so far to date on an annual basis is about 4% increase. Now, what do they project going forward? They figure this year we’re going to finish up about 3.9 or 4%; I think it might even be a little bit higher than that. 2016 they believe that we're going to go back to historical norms, which is a good thing. That’s only going to happen if we get the supply up. If the supply remains low and demand continues to skyrocket, those prices are going to go up even more, which I know it’s good for us individually. That means our personal real estate portfolio increases even if we own just the house we live. But remember, what we’re looking for in the market is a stable market that both buyers and sellers can easily get involved in. From 2017 to 2020, they present a little under historical norms; again, the pendulum will swing back a little bit. Let’s take a look at accumulative house price appreciation based on that same report. The Bulls, the top 25% of the people in that report, people that are most optimistic think that prices are going to go up 30.4% in the next five years. If we take a look at all of them, they think cumulatively prices will be up over 20% over that same period. And the Bears, the most negative, the bottom 25%, the pessimists in the group, still think that prices will be up well over 10%, 13.8% over that same period. Switching from the Home Price Expectation Survey over to CoreLogic’s projections, we can see that almost every state in the union, except for West Virginia, every other state is going to see a marked increase in prices according to CoreLogic. They project a larger increase in prices than the Home Price Expectation Survey does. What’s that saying? Prices are up, they’re continuing to rise; that’s good news for the most part. So what did they just say? They just said that according to the title agents that were surveyed, the biggest challenge we’re going to have is the appraisal situation. That’s because prices are going up pretty nicely and the appraisers are not judging what’s going to happen in the future; they’re judging what happened over the last six months. This report put out by Quicken Loans. The bad news is there’s still a discrepancy, and that discrepancy is almost 2%. That means on a $400,000 house there’s an $8,000 discrepancy. That could kill a deal. But the good news is that discrepancy is now, where it was growing every month all the way through September, the last three months that’s receding. The difference is getting smaller. It’s still an issue, there’s a difference, but the good news is the problem is getting smaller. But that’s the bad news about rising prices; they’ll leave some appraisal issues. The good news: We can put a graph together like this. We assume that someone closing a house this month, January 2016 if we take a look at the Home Price Expectation Survey, where they think prices are going to be over the next five years, how much equity would a homeowner gain just on price appreciation? And what we can see, on a $250,000 house, in five years that family net worth will increase by over $40,000. One of the great benefits of homeownership. And with rising prices, other things happen; people start to gain equity. Well, here let’s take a look at the pent‐up seller demand. According to Forbes magazine, where they quote the NAR statistics. From 2001 all the way up to 2008, it was consistent. People stayed in the house they purchased about six years. But when the housing crisis hit, people were either forced to stay in their house because of less equity or they were afraid to make a move up because of where the economy was, so that six‐year number moved to seven years, and then eight years, then nine years, then ten years. This past year it fell back to nine, but all that green area you see on this chart, that’s all pent‐up seller demand. That number’s going to come back down to six, because those people that have been in the house seven, eight, nine, and ten years, they want to sell, they just don’t know that they can. The only two states that have less than 85% of the homes in positive equity are Nevada and Florida. And if we were going to guess, we would guess that 50% of those houses had positive equity because they were hit so hard. Even in Nevada and Florida, eight out of ten homeowners, if you sit down in front of that have a mortgage have positive equity. Lawrence Yun put it best; he was talking about families. There are still many homeowners in the wrong home as life events have affected their living situation, and they will naturally be seeking to find the right home. There are plenty of people finally have their kids, their adult children, move out of the house. They’re now living in a four‐bedroom colonial they no longer want to heat, to pay for the air conditioning, and to take care of the grounds. Now that the kids are gone, they can go ahead and sell that house and move into a nice condo in the area where they can still be close to their job for the last several years of their employment, and they can still be close to some of their family. They could take the rest of the money from the sale of that house and buy that vacation home that will eventually turn into a retirement home either up in the mountains or down on the water. That’s what people normally do. But because of the last couple of years and the fear that the last couple of years have brought about, people are afraid to make those moves.  Let’s go over the updates quickly. Report on Fannie Mae’s Home Price Sentiment Index, and we can see it’s bouncing off the highest numbers that it’s had since all the way down in 2011. NAR is reporting that 32% of all transactions are first‐time homebuyers. The AEI International Center on Housing Risk, they want to differ with that number, and they take it on pretty strongly. They believe that last month 52% of all homebuyers were first‐time homebuyers. Remember what we talked about before. The person most, or the people most impacted by rising interest rates are first‐time homebuyers. If about 50% of all the buyers are first‐ time homebuyers, that’s a big number, and rising interest rates may impact them. Here are the final rates for 2015, and we can see they went up and down. But if we take a number all the way to the left and draw a line to the number all the way to the right, there’s slowly going up over the year. Home prices, Case‐Shiller; we had that big spike in January 2014, year‐over‐year increase. Remember, this is the year‐over‐year price increases. Then it leveled, fell, and then it leveled out; it’s starting now to tick up. If you look at the next graph, you can see that a little easier. We had double‐digit appreciation year over year in January and February, March, April of 2014. Then in September of 2014 all the way through August of this past year, the numbers settled out, just about 4 1/2 to 5%, because inventory was just a little bit below where it needed to be. Now that the inventory is falling again, and demand is picking up, home prices are starting to increase. As prices increase, especially if interest rates also increase, we’re going to start pricing a lot of buyers out of the market; that’s going to stop some of the sales. And the best market we can have is where both the buyer and seller can feel confident getting involved in the market, whether they’re selling or buying a home. Existing home prices year over year across all the regions are still strong as far as sales are concerned. Percent change in sales from last year by price range; the vast majority of the drop, the vast majority of sales, are under $250,000. North of that $250,000 number, sales are still pretty strong year over year. Existing home sales ‐ and here’s a good way to look at this, ladies and gentlemen. We have now reported on 11 months; December numbers are not in yet. Of those 11 months, there were two months that there was kind of like a tie, maybe three months if you include October. The other eight months, we had more sales each and every month than we did last year, and some of those months it was dramatically more sales. Let’s take a look at pending home sales. It has fallen over the last couple of months because of a lack of inventory and because of seasonality. We can see that just looking at the ‐ from January 2014 to the current time. It’s falling off a little bit, but still strong. Pending home sales year over year, in every one of the markets, is still strong. New home sales; still the sweet spot is between 200 and $300,000; the second, 300 to $400,000. New home sales, again, we’re doing very, very well compared to last year. Not compared to 2006 and 2005, but we’re doing much better than we did last year, and I think the numbers in 2016 are going to surpass the numbers even in 2015. Months inventory of homes for sale, we have to get that back to six months. Looking at it over the last two years we can see that we actually over the last two years we haven’t hit a time when it was six months. Taking a look over the last 12 months, we haven’t even hit five-and-a-half months, and if we look at 2015, same thing, pretty much the same thing as the last 12 months. We haven’t even hit five-and-a-half months any month. I’m glad that it went up a little bit this past month; that might just be because some of those houses didn’t close because of TRID. Well, if you’re looking to move up, I want you to understand that interest rates are going up, too, and so are prices. So you’ll lose a couple of that increase in price on your house, but you know what? That house you’re thinking about buying is going to be more, plus you’re going to have to pay a higher interest rate. Just look at the date here. Resources

|

MONTHLY NEWSLETTERArchives

October 2022

Reviews on Zillow 3354592 "We met Mike when we were house hunting in Albany, one of the most prized neighborhoods in the bay area. Mike with his honest and charismatic ... more "  5.0/5.0 5.0/5.0 by manelle ouaaz8 2103529 "Michael assisted me in locating a home and financing the mortgage. First, being new to the area, he was patient as I gathered information about the ... more "  5.0/5.0 5.0/5.0 by MichaelGoetz8 1271135 "Mr. Michael Ertem has been the top real estate professional I have been working with nearly 20 years. I have had half a dozen successful business ... more "  5.0/5.0 5.0/5.0 by pekkan6 Mortgage Calculator |

|

Northern Crest Realty

930 Dwight Way Suite 10A Berkeley, CA 94710 Cal Bre # 01977989 |

© Copyright Northern Crest Realty 2015

|

RSS Feed

RSS Feed