|

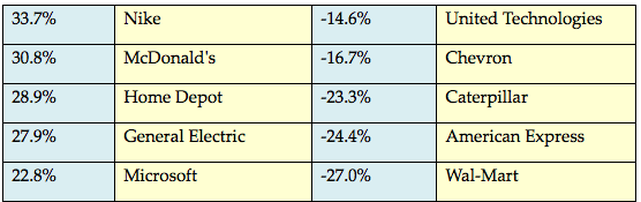

by Joe Garrett To Our Clients, Colleagues, and Friends: On Wednesday, February 17th from 2:00 p.m. to 3:30 p.m. Eastern, we're hosting an MBA webinar titled "Ten Things Your Company Must Do in 2016" that's geared toward mortgage company and bank CEOs, CFOs, and secondary marketing managers, and warehouse lenders, industry analysts, and others. We'll cover why your team should set key business goals and initiatives for management to achieve during 2016; why "doing as much volume as possible" should not be one of your goals; how your management team should organize, assess, and modify its goals throughout 2016; and offer ten concrete, practical suggestions for the coming year related to investor relationships, financial management, compliance, and operational performance. MBA members get a registration discount, but you don't have to be a member to sign up. For further information and to register, go to Ten Things Your Company Must Do in 2016. Let's say you graduated from college in 1985 and your parents gave you $1,000 that you decided to invest in stocks. Want to guess what the single most profitable stock was that you could have bought? It was then-tiny chemical maker Balchem Corp, up 107,099% in the following thirty years (1985-2015). That's an amazing average of 26.2% per year. The Wall Street Journal came up with 44 stocks that were up at least 10,000% over these past thirty years, with some recognizable ones being Home Depot, Amgen, Nike, Apple, Altria and Jack Henry. The most educational part is that each went through a near-death experience. Jack Henry lost 82% of its value from 1986-1989, and Apple stock fell by 79% between 1992-1997. The message isn't to find the big winners so much as to invest in great companies and hold on. There was a time not long ago when people were upset because the Japanese were buying iconic real estate like the Rockefeller Center. Along the same lines, a Chinese company just bought the rights to iconic American photos like these of Iwo Jima, Marilyn Monroe, and Rosa Parks on the bus. They are all part of Corbis, the photo archives now owned by someone in China. Steph Curry and the (46-4) Golden State Warriors: I finally figured out who Steph Curry reminds me of, and it's Walter Payton! What? Payton would be running full speed, and he'd slow down ever so slightly to cause the safety or cornerback to miss tackling him. And Curry will be dribbling down court at lightning speed, stop abruptly, and while the guy guarding him is trying to adjust, he'll pull up and take an open shot. On the left, that's Steph with his wife and daughter. He's probably the most beloved man in the Bay Area, the scrawny kid who is redefining basketball the way Babe Ruth once redefined baseball. Here are some Curry highlights (Steph Curry Highlights). These are really fun and really stunning. Ain't corruption a grand thing? A tidy $700 million was somehow transferred from the Malaysian government into the Swiss bank account of its Prime Minister. When members of Parliament started questioning this, the Malaysian government conducted an investigation of itself and found nothing amiss. What a surprise. Question: "You wrote about Willie Mays last week, and you seemed to have been a big fan. I thought you were an A's fan?" Answer: No one was a bigger Giants fan when I was growing up, but I switched loyalty to the A's when they moved to the East Bay during my sophomore year at Cal. A funny sidelight was that I went to Giants Fantasy Camp one year, and each of us got to shake hands with Willie Mays and have our picture taken with him. I had practiced exactly what I'd say when I met him. When it came time to shake his hand and get our picture taken, Willie couldn't have been friendlier but I completely froze. I'm normally a pretty good talker, but nothing came out. He gently kidded me and tried to loosen me up, but I finally muttered, "I can't believe I'm actually shaking your hand." It's hard to describe what a huge hero Willie was to Giants fans in the 1960s, and one day, I think in 1962, there was a big story in the sports section how a 13-year-old boy ran onto the field, shook Willie's hand, and immediately got arrested. This absolutely electrified every kid about his age, and especially me since I was 13 myself. I told my brother, Tony, "Man, I wish I had the guts to do that, to shake Willie's hand, and I'd sure like to meet that kid who did that." Fast forward 7-8 years. I had just transferred to Cal and my first week I met someone who had also just transferred. It somehow came out that he had been that kid who'd been arrested for running onto the field to shake Willie Mays hand. Barry Schneider has been one of my best friends ever since. He's a successful San Francisco lawyer, and framed in his office is the article about that day he shook Willie Mays hand in center field and promptly got arrested. What's wrong with this sentence from an analyst report: "BOFI operates the most unique model among SMID-cap banks, using its branchless model advantage to maximize operating efficiencies..." Something can't be most unique, as unique can never have a modifier attached. Something is either unique or it's not. Something can't be very unique, somewhat unique, or extremely unique. You know how we wrote last week about homeowners who were supposedly screwed by the banks and lost their homes during the subprime crisis? Writing about that made me think about a cartoon that was popular when I was a kid. It was called, Pogo, and a phrase that Pogo made famous was "We have met the enemy and he is us." I think about this whenever I read about homeowners blaming the banks because they lost their homes after lying about their income and getting subprime loans. When they complain, they might look in the mirror and paraphrase what this Pogo character said: "I have met the enemy, and the enemy is me." I had lunch with Cheryl O'Connor last week, and I couldn't be prouder. I met her in 1983 when she worked for Sunstream Homes. I was doing subdivision financing, and we did some bond financing for Sunstream. She was 25, the only woman in an all-male company, and I was there on a rare day when San Francisco got into the 90's. She was wearing her basic Diane Feinstein outfit. Skirt, sport coat, and a blouse buttoned to the neck with ruffles in front. All the men there had their ties loosened and cuffs rolled up, and if you don't already know, air conditioning doesn't exist in San Francisco. The place was sweltering, and I asked why she had her sport coat on. She told me she had to look ultra-professional all the time to be taken seriously in such an all-male culture. Anyway, she had a great career working for some major homebuilders, and she's now building a 16-unit project for battered women in Oakland. She's also being inducted into the California Homebuilders Hall of Fame. There are 243 members, and she'll be only the 14th woman. I couldn't be prouder of her. I remember when Cheryl and I went out to dinner once, I think to celebrate a bond deal closing. It was a little Italian Place in North Beach, and I saw people drinking something where the bartender would light it on fire and there'd be a blue flame on top. When dinner was over, I ordered two and chugged mine down. I didn't realize you were supposed to blow the flame out. I just assumed it would go out on its own in your mouth. When it hit my throat and burned like crazy, I reflexively spit it out. Two things happened then. The drink, whatever it was called, was sticky, so even though I spit it out, enough stuck to my lips that little blue fames were dancing on my lips. Cheryl screamed and threw her glass of water at my face. That solved the immediate problem, but the drink I had spit out set the paper tablecloth on fire. A waiter came running over and threw water on the table. Cheryl still remembers this dinner. Cheryl's aunt was a nun, so she liked this joke I told her at lunch: A woman joins a convent where new nuns can only speak two words every ten years. After ten years, she's given her chance to speak, and she says, "Hard bed." When another ten years have passed, she's give her chance to speak, and she says, "Horrible food." After yet another ten years, she's given her chance to speak, and she says, "I quit," upon which the Mother Superior says, "Good! Ever since you joined us, all you ever did was complain." The past year had winners as well as losers, kind of proving the truth to an otherwise ridiculous statement that, "This is a stock pickers market." Are you uncertain about how much due diligence you should be doing as a part of vendor management? Worried you're not doing enough, or perhaps too much? Try reading OCC Bulletin 2013-29 Third-Party Relationships. Even if you're not a bank, there's some good stuff in there. OCC Vendor Management Guidelines. About 30 years ago, my friend Barry Schneider (the guy who shook Willie Mays' hand) pulled out a Travelers Check to pay for dinner somewhere. When I asked him about it, he told me had come back from a trip with $400-$500 in unused checks that he kept around for spending money. It occurred to me that American Express got the free use of the money he paid six months earlier, and I found out that at any given time, there was something like $1.2 billion of paid for but unused Travelers Checks floating out there. Back when rates were much higher, this was a big earner for the issuers of Travelers Checks. I don't even know if Travelers Checks still exist, but gift cards do, and it's the same thing. The latest Barron's reported that since 2008, there are about $21 billion in paid for but unused gift cards. Really interesting. At the beginning of this newsletter, we referred to the Balchem stock that averaged a 26.2% gain per year for 30 years. Here's what it would be worth today based on how much you invested in 1985.

For companies with excess capital that don't know what to do with it: Since 2000 alone, Exxon has paid $380 billion in dividends and share buybacks. A good example of responsible management. A lot of today's mortgage bankers made bad decisions back in the subprime days, and strangely, are better for it today. As the saying goes, good judgment comes from experience, and experience comes from bad judgment. I mentioned that one to a friend who said, "I don't know if that applies to my banking career, but it's sure true for my relationships." I keep a sort of journal where I write down things I want to remember. I have lots of lines from novels, but I jot down other things as well. This is a favorite, something I copied ages ago. I no longer recall where I saw it, or who said it, but it's still funny: "Salesmen have a horrible reputation, but I love them. They look you in the eye, use your name a lot, hold your shoulder while they talk to you, and they laugh really, really hard at your jokes. They take you to expensive restaurants. They ask where you went to college and all about your kids, their ages and their activities. They suggest through body language and facial expressions that they would like to marry you. In other words, salespeople treat you exactly the way you wish everyone would treat you. Their only flaw is, of course, that they don't mean any of it. But isn't that a trivial defect, all things considered? Doesn't their insincerity seem like a minor shortcoming when compared to the fullness and richness of their devotion?" Please don't interpret this as being snarky. The salespeople I've known over the years, the really good ones, are, in fact, truly good people. And they really do care about your kids and where you went to college. We wrote last week about movies with emotional endings, and in no particular order, these were the ones you wrote us about. Old Yeller, I am Sam, Midnight Cowboy, Love Story ("Love means never having to say you're sorry."), Requiem for a Heavyweight, Sophie's Choice, The Notebook (I know someone who took a date to this to show what a sensitive person he was), and Forrest Gump. Thanks for stopping by. Let's do it again. And the cartoon? Moderately funny commentary on diversity in the Boardroom. Helping lenders increase revenues, control costs, and better manage risk. Joe Garrett (510) 469-8633 Mike McAuley (281) 250-2536 www.garrettmcauley.com An Article by Joe Garrett with his permission.

|

MONTHLY NEWSLETTERArchives

October 2022

Reviews on Zillow 3354592 "We met Mike when we were house hunting in Albany, one of the most prized neighborhoods in the bay area. Mike with his honest and charismatic ... more "  5.0/5.0 5.0/5.0 by manelle ouaaz8 2103529 "Michael assisted me in locating a home and financing the mortgage. First, being new to the area, he was patient as I gathered information about the ... more "  5.0/5.0 5.0/5.0 by MichaelGoetz8 1271135 "Mr. Michael Ertem has been the top real estate professional I have been working with nearly 20 years. I have had half a dozen successful business ... more "  5.0/5.0 5.0/5.0 by pekkan6 Mortgage Calculator |

|

Northern Crest Realty

930 Dwight Way Suite 10A Berkeley, CA 94710 Cal Bre # 01977989 |

© Copyright Northern Crest Realty 2015

|

RSS Feed

RSS Feed